Our Asset Management Leaders

The key to our success is our people

We act at Asset Management Level and Operate in all BTR sectors

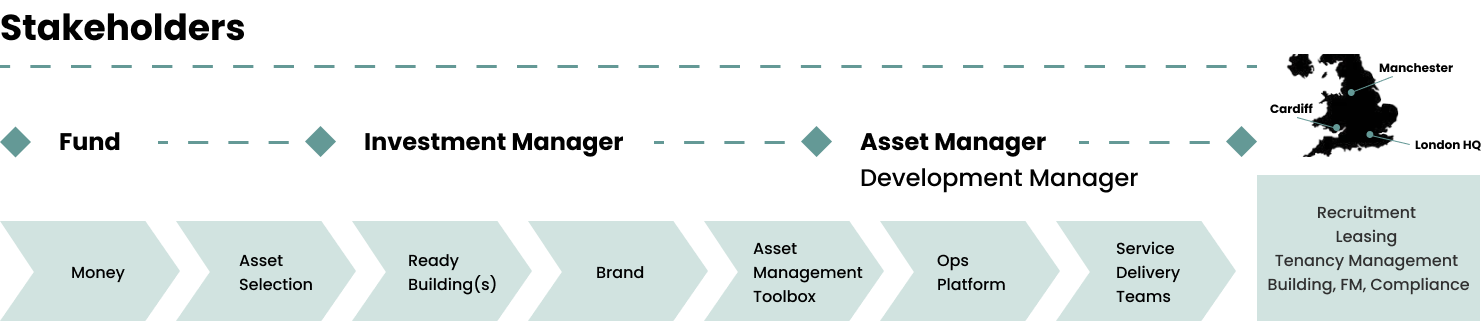

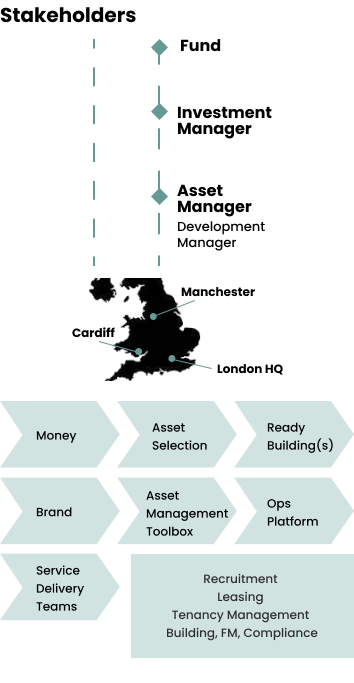

Ringley is a residential real estate-focused company that works with institutional landlords, family offices and investors to enhance the value of their assets. Headquartered in London with offices in Manchester and Cardiff, we operate manned and unmanned sites nationwide.

This is delivered through portals and a series of apps for residents, site staff and with leasing strategy and compliance run from HQ. Marrying the corporate ambition of improved operational models with the technology crucial to achieving this.

We operate across all BTR Living Sectors

From matching Clients to capital, through the underwrite, to design for operations, mobilisation, lease-up to management of

stabilised assets. Our teams have advised on over 11,500 BTR properties, and we have mobilised and manage thousands

With you for the Asset Management lifecycle

We have years of operational living expertise and the data too. We support Clients modelling the likely gross to net, looking at unit mix, unit typology, front and back of house, location of plant, facilities and small M&E.

We work alongside interior designers and select and manage ESG accreditations. We take care of the whole handover process: managing snagging and putting quality assurance systems in place for unit and development acceptance.

We procure furniture packs, gather in data, set up the tech and mobilise buildings. Then our operational team takes over: along the journey they will have studied the market demographic, competing properties, priced the units, built the brand, created the websites and social media assets that assure a good lease up.

Overview Asset

Management

"with building management and facilities that reimagine all the customer interactions."

Next-gen living is all about satisfying the well-travelled, experience-hungry, savvy resident. So our focus is on delivering people-first experiences that turn spaces into places for people to thrive.

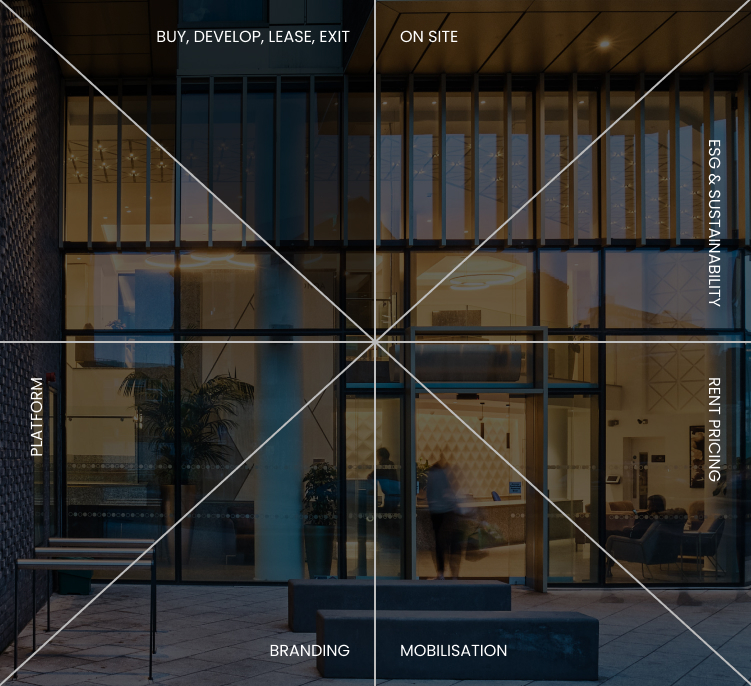

Facets of Asset Management

Underwrite

Modelling

With you for the Asset Management lifecycle

We have years of operational living expertise and the data too. We support Clients modelling the likely gross to net, looking at unit mix, unit typology, front and back of house, location of plant, facilities and small M&E.

We work alongside interior designers and select and manage ESG accreditations. We take care of the whole handover process: managing snagging and putting quality assurance systems in place for unit and development acceptance.

We procure furniture packs, gather in data, set up the tech and mobilise buildings. Then our operational team takes over: along the journey they will have studied the market demographic, competiting properties, priced the units, built the brand, created the websites and social media assets that assure a good lease up.

With you for the Asset Management lifecycle

We have years of operational living expertise and the data too. We support Clients modelling the likely gross to net, looking at unit mix, unit typology, front and back of house, location of plant, facilities and small M&E.

We work alongside interior designers and select and manage ESG accreditations. We take care of the whole handover process: managing snagging and putting quality assurance systems in place for unit and development acceptance.

We procure furniture packs, gather in data, set up the tech and mobilise buildings. Then our operational team takes over: along the journey they will have studied the market demographic, competiting properties, priced the units, built the brand, created the websites and social media assets that assure a good lease up.

Fassest Of Asset

Management

Brands For

Sale

PropTech

That Deliver

Planning The

Resident Journey

Market

Insights

Underwrite

Modelling

Project

Monitoring

ESG Strategy &

Accreditations

Our living sectors

platform delivers

Operational Excellence

- Experience: AM/PM 17k+ units

- Proprietary tech platform that

reduces OPEX by up to 4%

Ready-made

Platform

- Deep industry connections

- Platform running 17,500 units

- Our senior leaders advise the

Housing Growth Partnership

- Institutional Client base

Deal Flow

- We own VirgnLand who are a

digital land sourcing TechCo

- 1,000s of active leads

- Land banking potential

Asset Management or Property Management: what do you need?

Asset management is market know-how to acquire land and/or buildings and create value, through strat land, development, asset repurposing, rent strategy, lease-up and improving tenant mix to drive total returns. Property management is the day-to-day lettings and tenancy management and repairs.

Ready-made living sectors platform: single tech stack

Imagine one tech stack, no data rework, machine learning, no schoolboy errors, safe governance and instant reporting, that's what we have developed.

How we drive returns & plan the exit

We are experts at running Net Operating Income (NOI) assets. We have the magic sauce to improve returns through tech-enabled processes, vertical integration and in-sourcing.

Discover our Properties

Why Ringley is the best choice for Asset Management

Residential real estate investment is now mainstream. However, the granularity of it cannot be under estimated, so as a partner we bring a ready-made residential real estate platform with team, tech and traction which can roll out as Una Living powered by PlanetRent or be white-labelled for you. To deliver a fully integrated model requires a scale of 60+ homes for retirement or later living and ideally 100+ homes for build to rent so that staff can be put on site.

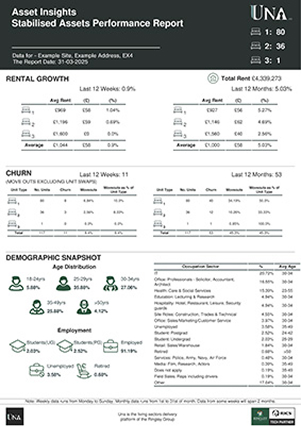

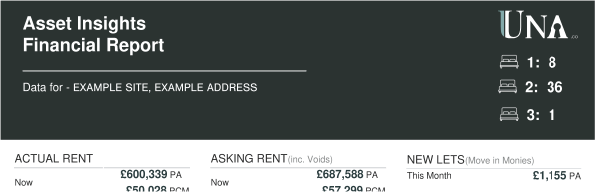

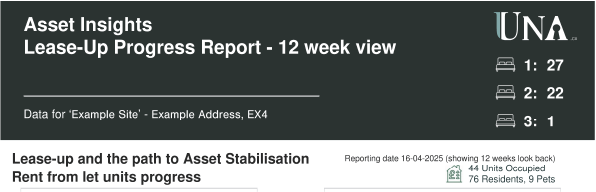

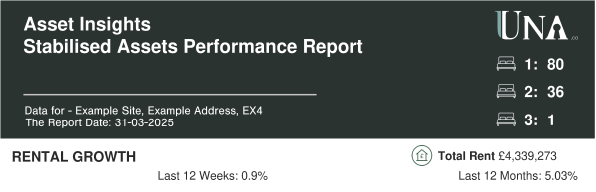

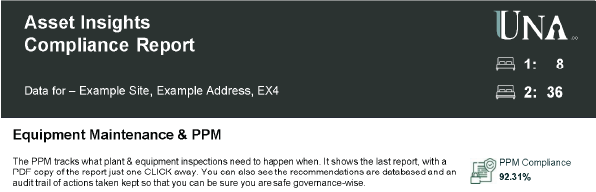

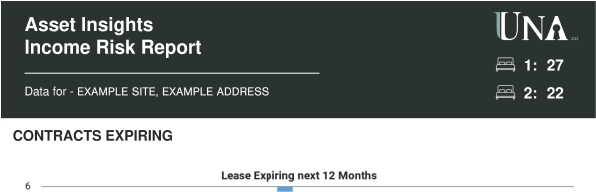

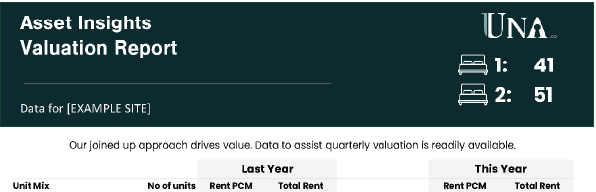

READ MOREUnrivalled Asset Insights

A family of reports that can be schedule weekly/monthly as you wish

Why Ringley is the best choice for Asset Management

Residential real estate investment is now mainstream. However, the granularity of it cannot be under estimated, so as a partner we bring a ready-made residential real estate platform with team, tech and traction which can roll out as Una Living powered by PlanetRent or be white-labelled for you. To deliver a fully integrated model requires a scale of 60+ homes for retirement or later living and ideally 100+ homes for build to rent so that staff can be put on site.

To move into the living sectors whether it be ‘build to rent‘, ‘retirement’, ‘later living’ or ‘student’ you will need an asset manager who provides executive leadership as well as expert hands-on project monitoring, mobilisation, leasing and operational teams. In partnerships, our mandate is the level of delegated authority that suits you. Our Asset Managers are focused on driving value by delivering rent premiums, reducing the gross to net leakage to improve total returns - all the while furthering the sustainability agenda and they have the commercial acumen to do so.

Partnering with Ringley delivers a full in-house solution and decades of residential real estate experience. Our multi-disciplinary expert teams have national reach UK Asset Management and a successful track record with funds, investors, landlords and property developers. We collect and share data effortlessly. Together we cut down the layers of management, reducing the players, workload, rework and confusion as well as the associated cost. This optimises total returns for our clients' investments and ensures your site is effectively asset managed.

We partner with capital and investors looking to enter the UK living sectors providing a strategic lead through design and build and a ready-made operational platform beyond for build to rent, coliving, later living and student.

What is Asset Management?

Asset management is the strategic oversight and administration of real estate assets to maximise their value and performance. It involves a comprehensive approach to managing properties, encompassing everything from acquisition and development to ongoing operations and eventual disposal.

Property asset managers are responsible for optimising the financial returns of a real estate portfolio by making informed decisions on leasing, maintenance, and property enhancements. They also assess market trends, analyse risk factors, and develop long-term strategies to ensure that properties generate consistent income and increase in value over time.

Living sectors residential

real estate platform

As an operating partner, we have closed the gap in the market for an end-to-end living sectors platform. We are vertically integrated: from asset management to facilities and property management. We run each fund’s chart of accounts throughout and harvesting data to eliminate re-work.

Underlying all of this is AI and robotic accounting which covers all aspects of asset reporting including:

- Liquidity ratios

- Valuation input variables

- ESG reporting

- Golden thread data

- Fire compliance

- Planned property maintenance performance

- Units compliance

- The net promoter score

- Site staff inspections

- HR management

Ringley Asset Management offers boundless proactive thinking and enviable responsiveness from our team of highly accessible portfolio managers. From 'virgin land' to 'deal underwriting' we navigate the markets. Our market intelligence is insightful as is our proprietary research and well-informed thoughtful ESG leadership.

Our Asset Managers treat your property as an investment: their overriding objective is to maximise total returns and enhance the value of each asset. This requires a head for numbers and a commercial outlook combined with entrepreneurial thinking.

- deliver the investment strategy: buy, sell, hold, pricing and returns.

- undertake due diligence work, make recommendations and negotiate on behalf of the owner.

- determine the required leverage and work with lenders.

- establish the value of each asset and create the asset level business plan to drive value

- prepare long-term financial forecasts, perform cashflow analysis and work out the rate of return

- carry out market research, analyse data and market assets to increase revenue

The Facets of Asset Management explained

We manage transition. From management audits to achieving or bettering ESG accreditations, design for operations and everything in between.... Challenge us:

Why Ringley is the best choice for Asset Management

Residential real estate investment is now mainstream. However, the granularity of it cannot be under estimated, so as a partner we bring a ready-made residential real estate platform with team, tech and traction which can roll out as Una Living powered by PlanetRent or be white-labelled for you. To deliver a fully integrated model requires a scale of 60+ homes for retirement or later living and ideally 100+ homes for build to rent so that staff can be put on site.

To move into the living sectors whether it be ‘build to rent‘, ‘retirement’, ‘later living’ or ‘student’ you will need an asset manager who provides executive leadership as well as expert hands-on project monitoring, mobilisation, leasing and operational teams. In partnerships, our mandate is the level of delegated authority that suits you. Our Asset Managers are focused on driving value by delivering rent premiums, reducing the gross to net leakage to improve total returns - all the while furthering the sustainability agenda and they have the commercial acumen to do so.

Partnering with Ringley delivers a full in-house solution and decades of residential real estate experience. Our multi-disciplinary expert teams have national reach UK Asset Management and a successful track record with funds, investors, landlords and property developers. We collect and share data effortlessly. Together we cut down the layers of management, reducing the players, workload, rework and confusion as well as the associated cost. This optimises total returns for our clients' investments and ensures your site is effectively asset managed.

We partner with capital and investors looking to enter the UK living sectors providing a strategic lead through design and build and a ready-made operational platform beyond for build to rent, coliving, later living and student.

Residential real estate has proven to be a valuable sector for investors who embrace the need for a bespoke residential platform and who are ready to treat tenants as discerning customers. To deliver a fully integrated model requires scale 60+ homes for retirement or later living and ideally 100+ homes for build to rent so that staff can be put on site.

To move into the living sectors whether it be ‘build to rent‘, ‘retirement’, ‘later living’ or ‘student’ you will need an asset manager who provides executive leadership as well as expert hands-on project monitoring, mobilisation, leasing and operational teams. Our Asset Managers are focussed on driving value by delivering rent premiums, reducing the gross to net leakage to improve total returns - all the while furthering the sustainability agenda and they have the commercial acumen to do so.

Partnering with Ringley delivers a full in-house solution and decades of residential real estate experience. Our multi-disciplinary expert teams have national reach and a successful track record with funds, investors, landlords and property developers. We collect and share data effortlessly. Together we cut down the layers of management, reducing the players, workload, rework and confusion as well as the associated cost. This optimises total returns for our clients' investments.

We partner with capital and investors looking to enter the UK living sectors providing a strategic lead through design and build and a ready made operational platform beyond for build to rent, coliving, later living and student.