Our PlanetRent Tech Team

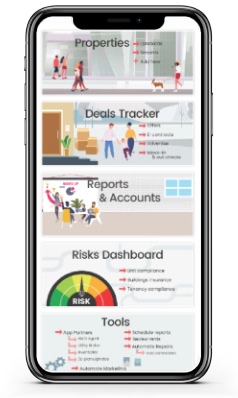

Property Management Software

What does vertically integrated mean?

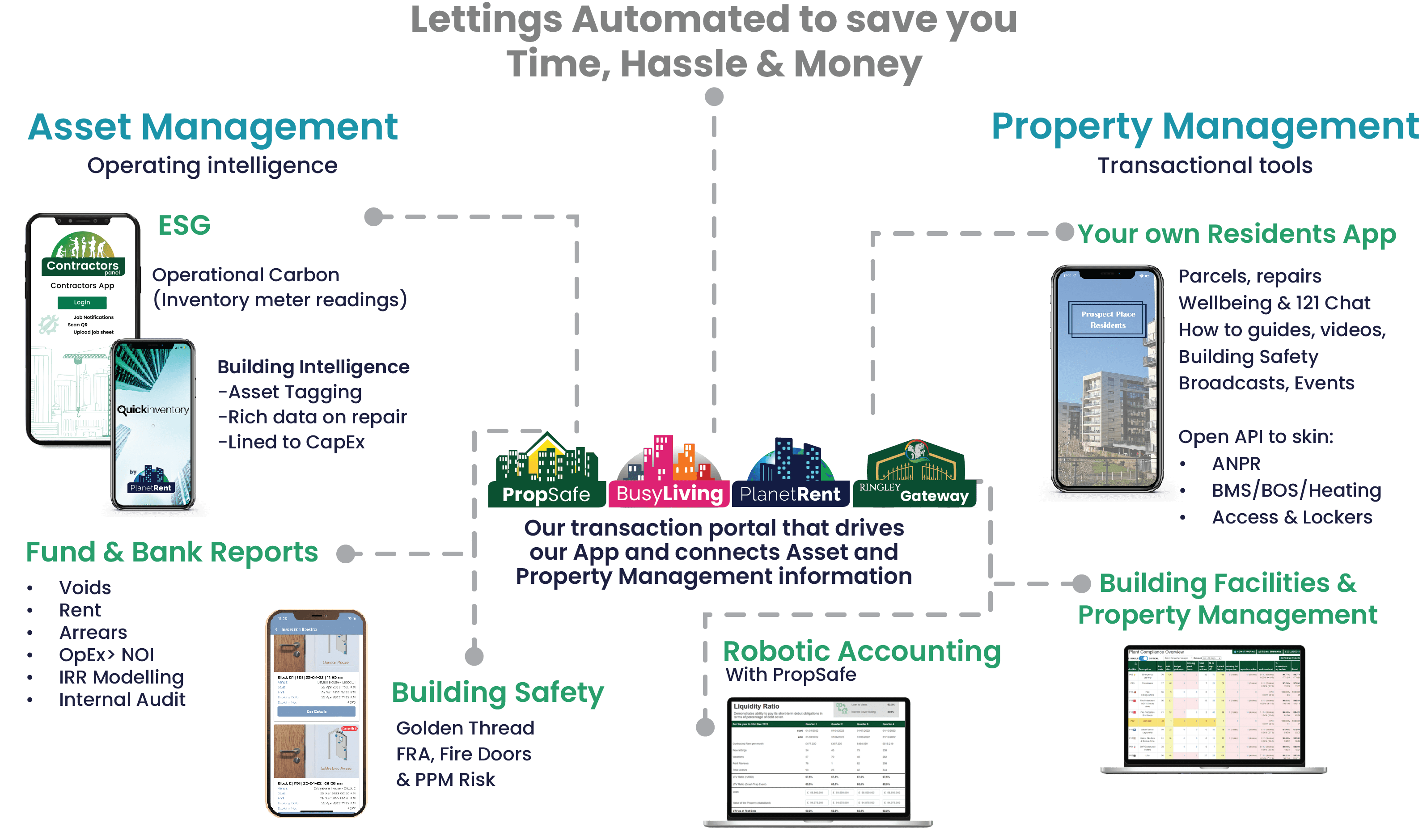

Our vertically integrated tech brings everything together—streamlining service delivery, cutting operating costs, and making roles simpler by automating accounting and back-office tasks. The result? A smoother operation and better service for everyone.

Software:

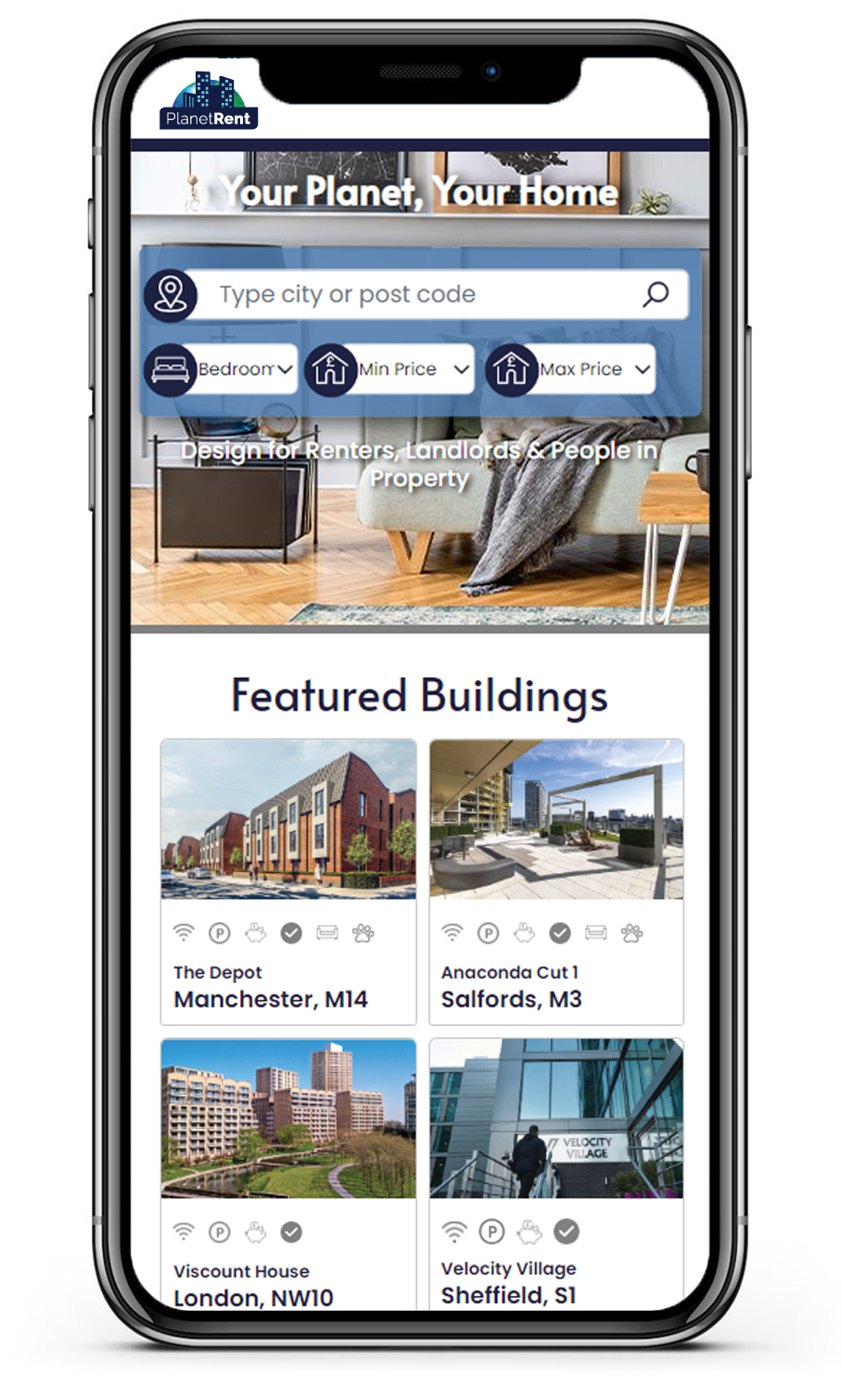

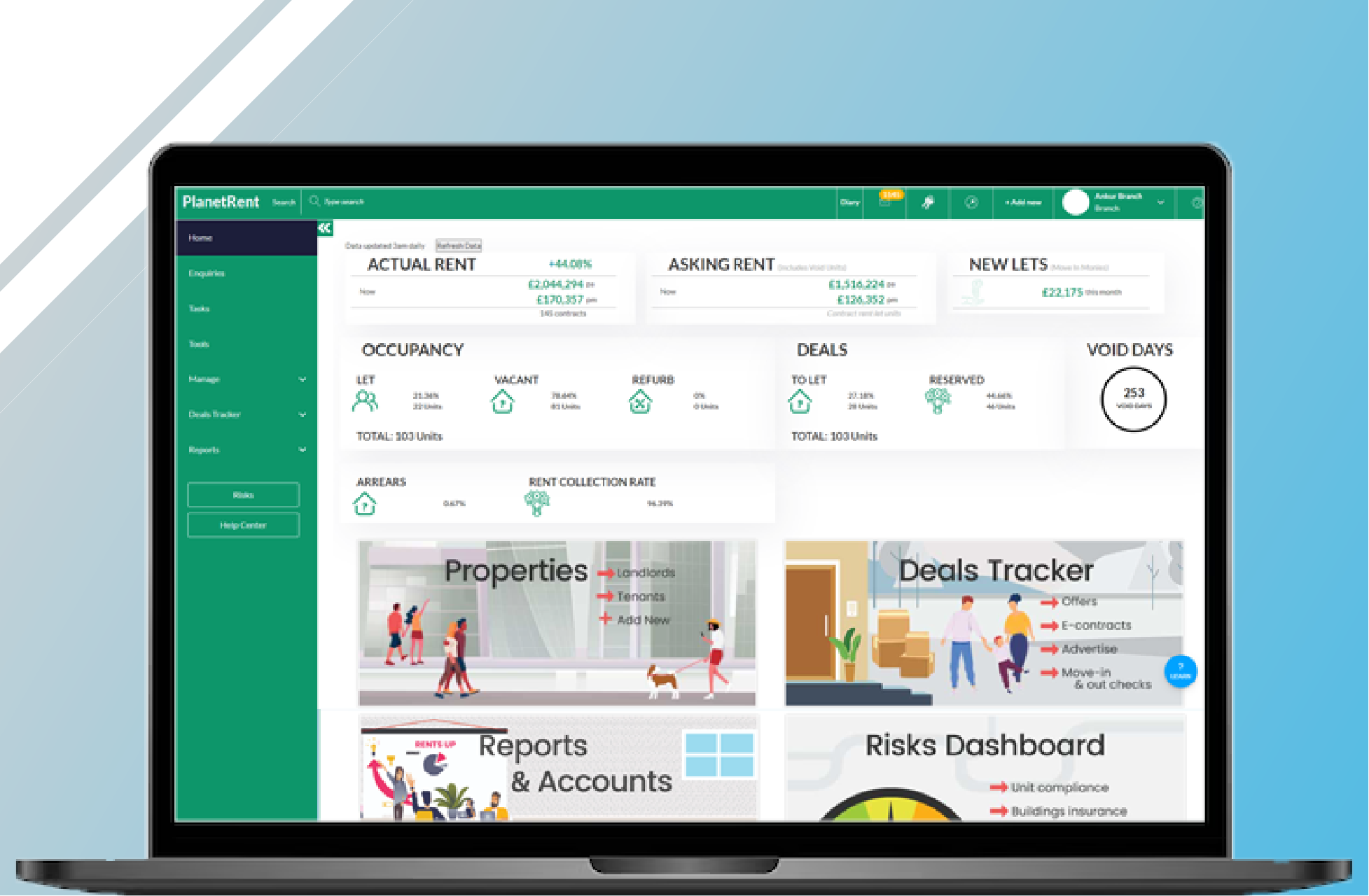

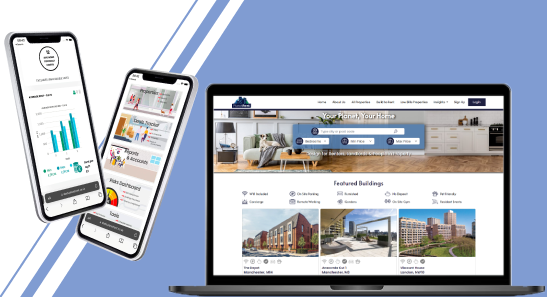

How technology underpins your Build to Rent strategy

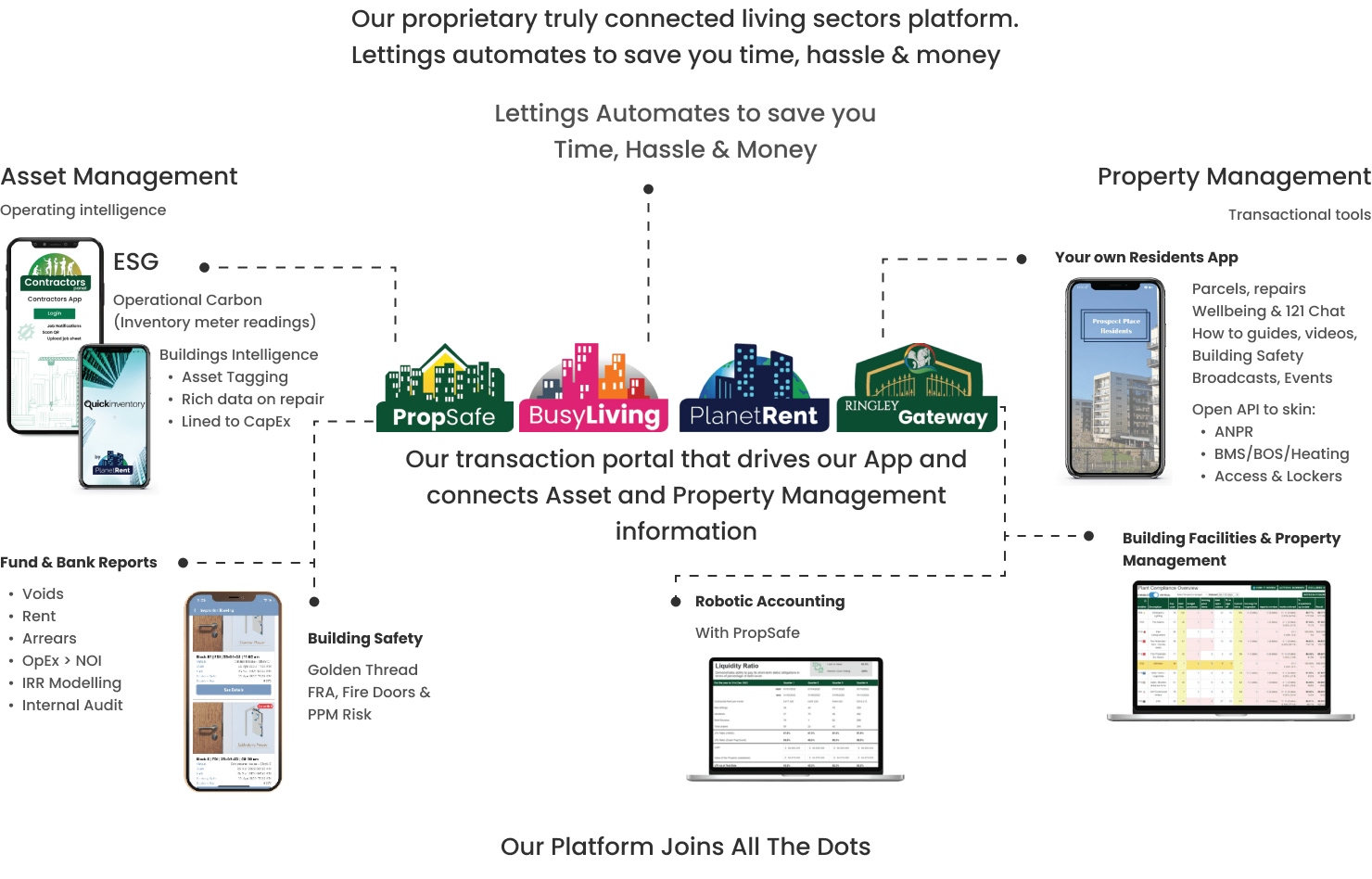

Our Platform joins all the dots

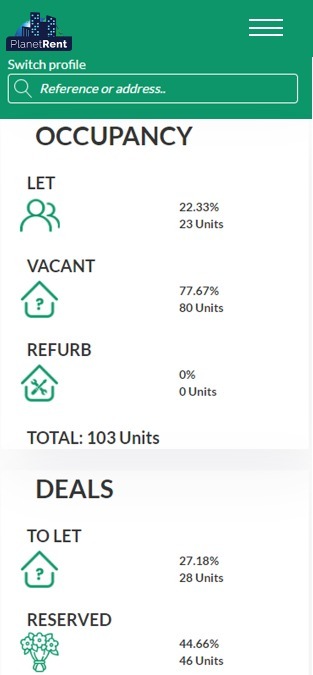

To boost returns at scale, we turn data into strategy. The platform tracks over 100 key metrics—covering everything from resident satisfaction and viewing feedback to rental growth, occupancy, churn, operating costs, utility losses, arrears, demographics, rent collection, on-site staff and more.

Data

Informs whether there are too many 'move outs' in July, rents vs affordability of your residents to feed into rent pricing. By adopting the fund level chart of accounts, we get rid of re-work and support vertical integration.

Governance

Guided decisions and stop mechanisms prevent schoolboy errors, inducting new staff is a breeze and we save time so your leasing staff can focus on driving rents, cost control and cost recovery to maximise the gross to net.

Automation

Of processes such as renewals, setting rent increases to queue for the next tenancy, messages and emails to chase rent arrears, and data connections make light work of deposit recovery. When the tenancy is ending our automated vacate process will take care of that too.

Plug and play

We have already integrated all these partners so all you need to do is to add your Client credentials.

Money sorted

Rent ledger work at lease-up, renewal, tenancy substitution, add-ons for car parking or pet rent, move-out, deposit return and more is all automated. Leasing staff make the decision, PlanetRent takes care of the accounting.

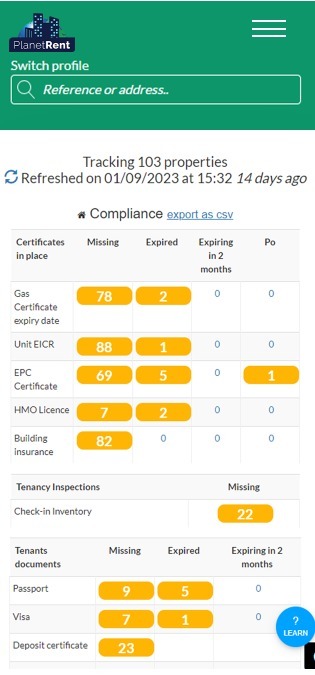

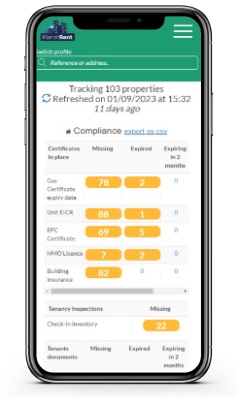

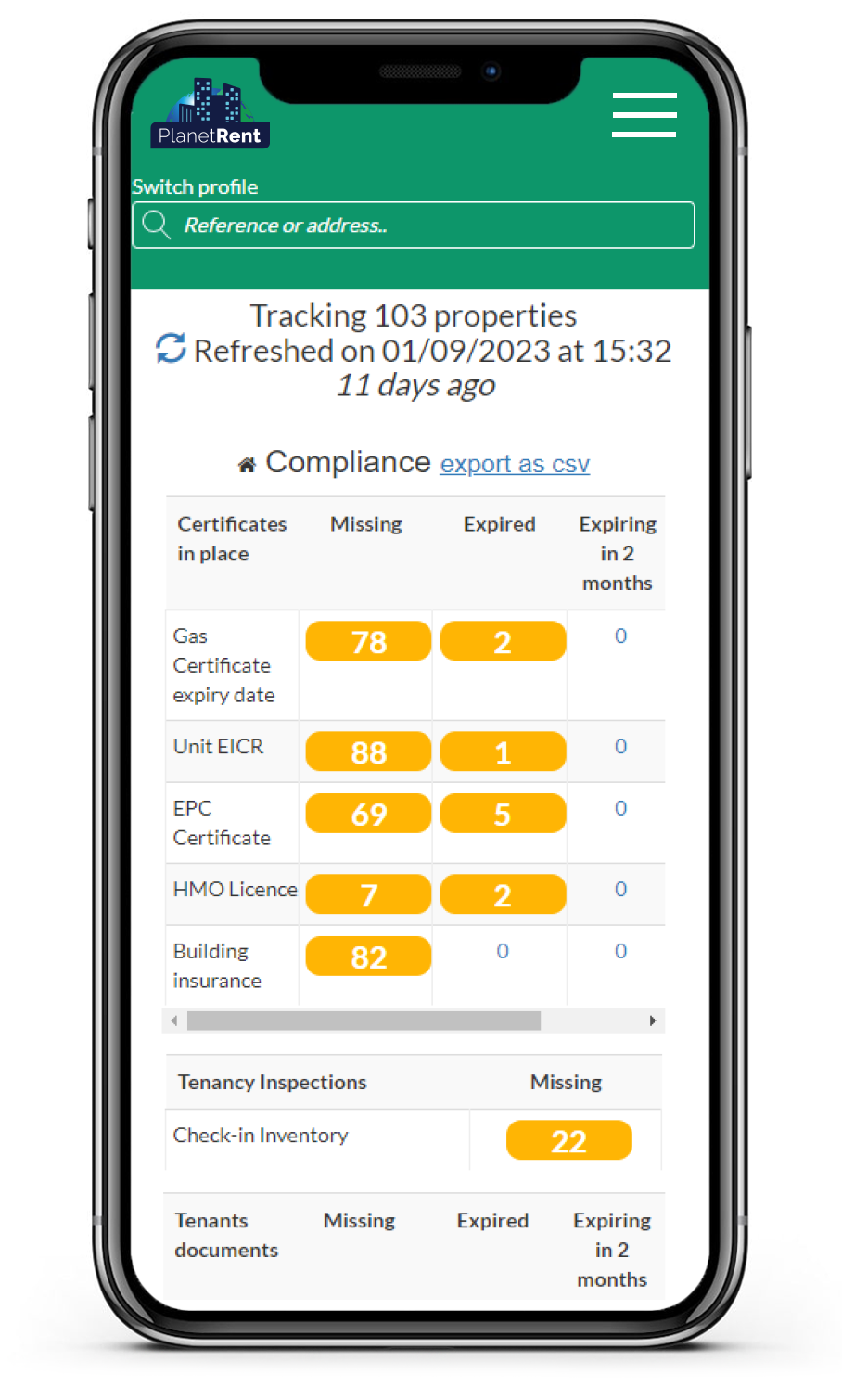

Compliance

As well as dashboards showing docs expiring, the system is designed so you can set up weekly reports to prove ‘New-Lets Compliance’ and ‘Move-Out Compliance’ are all in order. In addition the tech covers planned preventative maintenance, fire door, fire risk assessment and monthly building safety act inspections.

What our Users say

“we left Yardi because It's a closed platform that doesn’t integrate with anything meaning we couldn’t tailor the experience, and, they wouldn’t adapt their product to suit our needs - commercial or customer. It does lots of things but badly, for example, tries to be a CRM, email system, SMS system, tries to handle e-commerce and website, etc. Automation is low.”

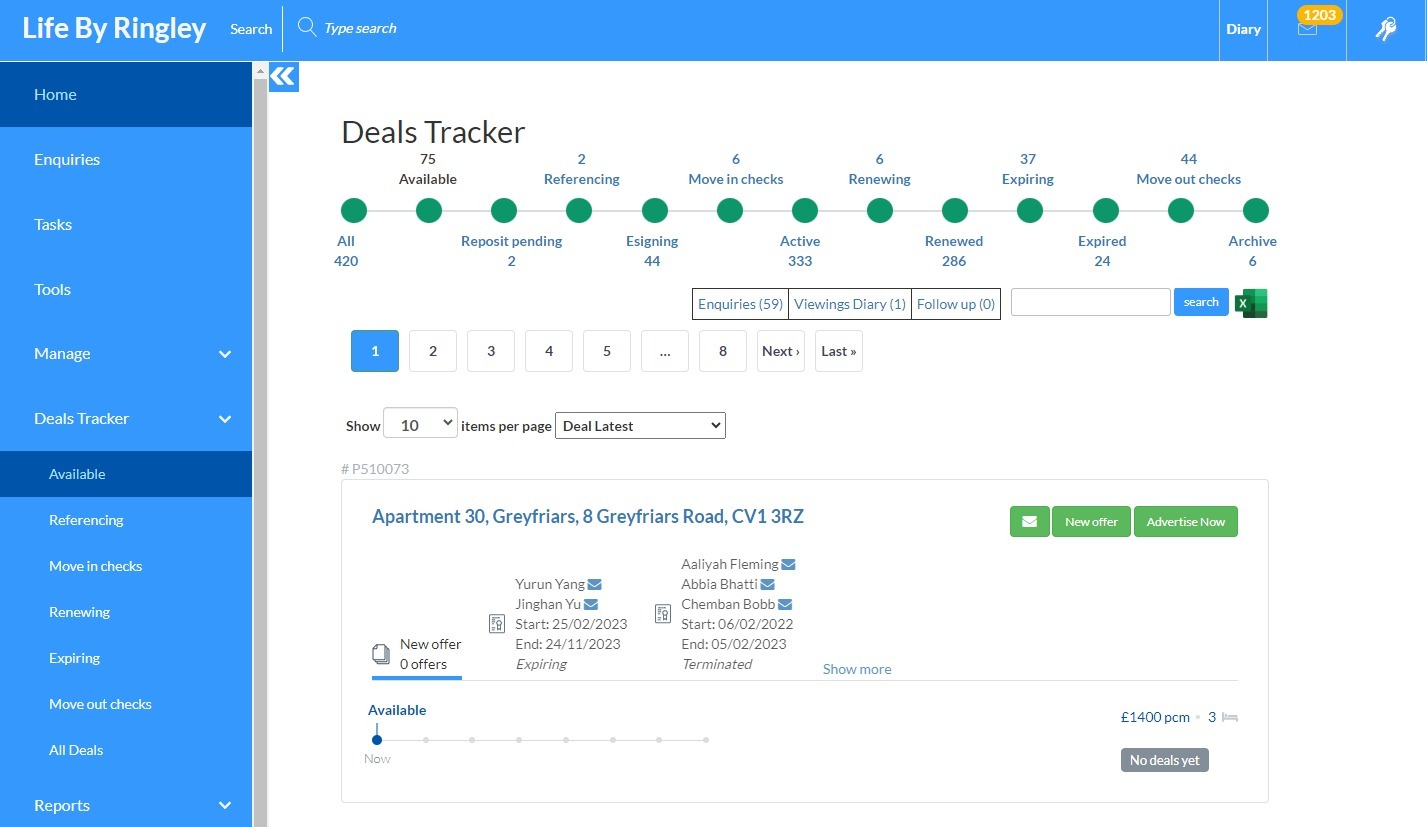

Property Lifestyle Apps:

The Experience layer tech for Build to Rent

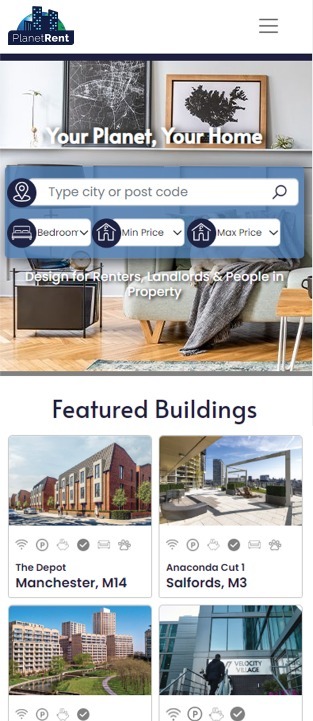

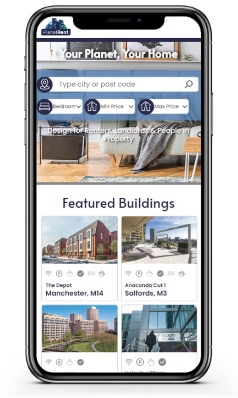

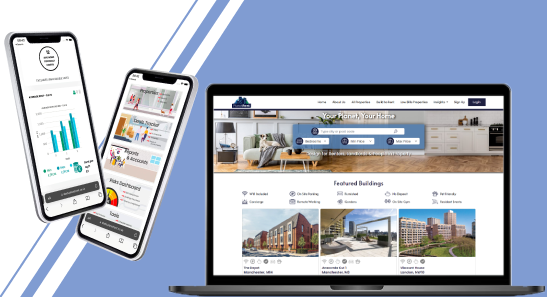

Property Leasing Apps:

Compliant lettings every-time

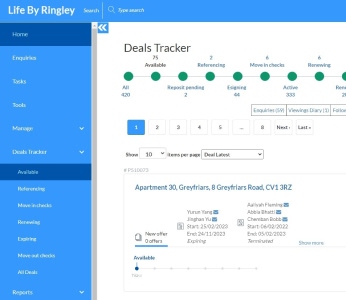

Leasing

PlanetRent is so much more than Spike Global or Yardi Rent Cafe, Real Page or Qube. We’ve spent years meticulously planning every customer journey. Robots run the accounts so the accounting is right first time, even if the customer changes their mind, switches units, varies their dates or decides to move out early.

“We see renting a home as a service for residents to experience and consume, and you need great tech to achieve that!”

tenancies

Compliant tenancies

PlanetRent delivers a compliant move in process, right to rent checks, EPC disclosure, Gas Safe disclosure, HMO Licences, ECIR Certificates, move in checks, deposit scheme leaflet and registration, the Government How to Rent Guide and prescribed information.

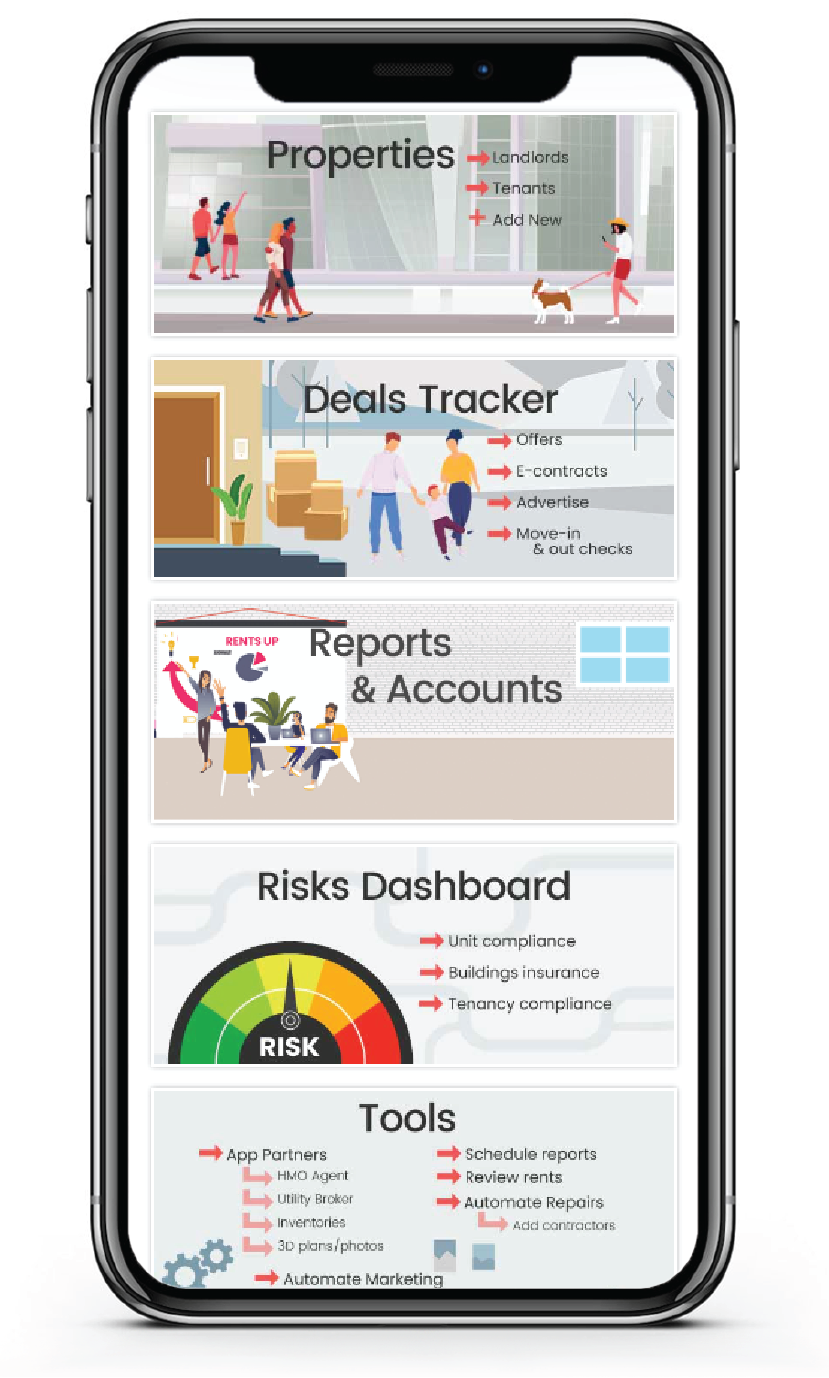

PlanetRent

Lettings automated to save you time, hassle & money. We have simplified all aspects of lettings and property management, unit and building compliance, facilities management and building safety act compliance too.

made easy

Deposits made easy

To keep you safe governance-wise PlanetRent automatically registers deposits and uploads the deposit certificate for you. Through our tech link to both Reposit (our deposit alternative partner) and TDS - the Tenancy Deposit Service deposits are also de-registering at the end of the tenancy to save you money.

Environmental

We believe tech can drive environmentally conscious living. Residents can scan QR codes on appliances and connect to video-based home user guides, showcasing appliance energy efficiency features and how many trees can be saved. By mining Inventories for energy usage you can laud the champions and recognise smart energy use.

Our technology enhances workforce efficiency by automating repetitive tasks—including demands, allocations, bank reconciliations, arrears management, marketing, feedback analysis, and PPM. This empowers leaner teams to focus on higher-value initiatives, such as strengthening community engagement.

Property Management Software: Spotlight on Tenancy and Facilities Management

Compliance FIVE ways: Know your risks and what you need to manage

Unit Compliance

See what is missing or due soon: Gas Safe, ECIR, EPCs, HMO Licences.

Keeping this up to date feeds the automated ‘Welcome Journey’

The New-Lets Compliance reports tells you of any gaps to backfill.

Updating data auto sends to the landlord and tenants for you.

Building Safety Compliance

A suite of inspection apps covers:

- Fire doors

- Fire risks

- Building Safety Act

Combined with Asset Tagging, Residents can scan QR codes to see plant maintenance records.

Our Building Safety Case tools will help you get your Building Safety Case done.

Facilities Compliance

The Planned Preventative Maintenance plan 'PPM' diary shows what needs maintaining and when. By uploading reports and databasing actions, inspections compliance and actions compliance is easily trackable.

Tenancy Compliance

Tenancies, licences, pet rent, and car park licences are all e-signable.

The government How to Rent Guide, Prescribed Information and Deposit Registration are automatically issued.

Tenant Compliance

It’s easy to check that your right to rent checks are in order: passports and visa expiry dates, these feed into renewals to evidence you re-check them.

The New-Lets Compliance reports tells you of any gaps to backfill.

Property Management Software: Robotic Finance and Accounting

Money Management FIVE ways

We’ve linked the OpEx Budget to the Plant Asset Register. This means Facilities Managers, Property Managers and Accountants all live inside the budget module reducing rework by miles.

Real time budget:variance reporting clicks through to invoices, with instant ability to recode expenditure and machine learning doing this for Users.

You can upload a unique chart of accounts for each Client. This powers consolidated portfolio reporting.

A bank feed, machine learning and robotic accounting means you don’t need a treasury department. Receipting, allocations, bank reconciliations and re-coding expenditure is all robotic.

Robots chase arrears twice weekly by text and email, including chasing guarantors from day one.

Use tools to review rents – which save for the next deal, analyse rent pricing, or check affordability ratios.

Robots chase arrears twice weekly by text and email, including chasing guarantors from day one.

To maximise rent collection we collect from residents individually, but treat debts jointly and severally.

To support decision making reports show ‘rent at risk’ based on residents payment performance, and the deposit recovery.

All our users know their OpEx and other financial KPIs available in a 12 month grid instantly.

Reports can be scheduled in PDF and EXCEL as often as you like.

No matter how many assets you have, it takes just one click to aggregate and report on your whole portfolio.

Reports can be scheduled in PDF and EXCEL as often as you like.

Property Management Software: Spotlight on Tenancy and Facilities Management

Compliance FIVE ways: Know your risks and what you need to manage

Unit Compliance

See what is missing or due soon: Gas Safe, ECIR, EPCs, HMO Licences.

Keeping this up to date feeds the automated ‘Welcome Journey’

The New-Lets Compliance reports tells you of any gaps to backfill.

Updating data auto sends to the landlord and tenants for you.

Building Safety Compliance

A suite of inspection apps covers:

- Fire doors

- Fire risks

- Building Safety Act

Combined with Asset Tagging, Residents can scan QR codes to see plant maintenance records.

Our Building Safety Case tools will help you get your Building Safety Case done.

Tenancy Compliance

Tenancies, licences, pet rent, and car park licences are all e-signable.

The government How to Rent Guide, Prescribed Information and Deposit Registration are automatically issued.

Facilities Compliance

The Planned Preventative Maintenance plan 'PPM' diary shows what needs maintaining and when. By uploading reports and databasing actions, inspections compliance and actions compliance is easily trackable.

Tenant Compliance

It’s easy to check that your right to rent checks are in order: passports and visa expiry dates, these feed into renewals to evidence you re-check them.

The New-Lets Compliance reports tells you of any gaps to backfill.

PropTech & Living Sectors Platform

"Technology is no longer an add-on but a lifecycle differentiator, an opportunity for frictionless resident journeys."

Ringley's techstack is the result of 20 years experience of managing residential real estate and covers everything from transactional leaseup, to the community experience, management of revenue and plant compliance.

PropTech: Vertically integrated

To drive returns at scale the data informs strategy, whether that be you have too many 'move outs' in July, or to automate processes such as renewals and rent arrears, or to set rent increases to queue for the next tenancy, or to make light work of deposit recovery. By simplifying transactions to guided decisions with automated ledger postings, teams can focus on driving rents, cost control and cost recovery to maximise the gross to net.

Rent pricing, pet rent and utilities management are part of what we do. Our techstack is agile and supports vertical integration by adopting the fund level chart of accounts to get rid of re-work on fund accounting and reporting.

PlanetRent

Simply process & compliance

PlanetRent

Compliant move in process

PlanetRent

Know your risks immediately

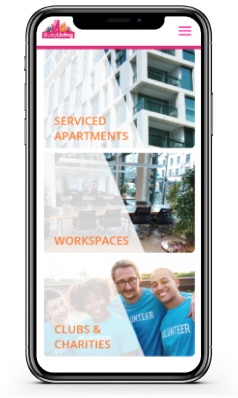

Busyliving

Is out lifestyle App

We are the 'vertically integrated data people'

1. Frictionless rental journey for residents, from finding a property to moving out.

2. Our App generator portal creates lifestyle apps branded to your schemes to showcase all that is on offer. Build community, manage repairs, and calculate your Net Promoter Score.

3. We share building safety with residents. They scan the QR code on the fire alarm or lift and can see maintenance records.

4. Drive environmentally conscious living. Residents scan QR codes on appliances and connect to video-based home user guides, showcasing appliance energy efficiency features and how many trees can be saved.

5. We start the conversation and foster a sense of community to reduce churn costs and reward those who stay.

6. Amenity and event marketing tools and resident surveys are included.

7. Vertical integration means less time collecting data, joining the dots and no re-work. Our living sectors platform tech is end-to-end not an array of off-the-shelf apps often with conflicting data structures!

8. Over 100 KPIs included: rental growth, churn, demographics, viewing feedback, arrears, rent collection rate, repairs, deposit performance, OpEx, PPM, fire doors and fire risk assessment actions and more.... Most drill down to unit type.

9. Our tech can reduce staff, it enables dual roles and drives staff efficiencies. It robots can do it (demands, allocations, bank recs, chasing arrears, marketing, viewing feedback, PPM), ours do. Our teams are leaner, and tech gives teams more time to drive community where a human face is needed most, e.g., front-of-house.

Operational Oversight -

your end-to-end living sectors platform

The real estate sector is undergoing a dramatic cultural shift: post pandemic new ways of living and working, open API collaborations and occupiers treating their home as an experience or service they consume collectively are factors re-imagining property as a service not a commodity. Together these are all accelerators.

Leasing

Unit Compliance

Tenant Compliance

Plant & Equipment Compliance

Revenue Management

Community Engagement

CapEX Management

Budgetary Control

Client Monies & New Lets Compliance

Governance & Compliance for the Living Sectors

Leasing, Marketing & Mobilisation

The Resident Journey

Leasing & Tenancy Compliance in the Living Sectors

Revenue Management & Reporting in the Living Sectors

PropTech to Asset Manage UK Build to Rent

Our techstack reduces the training burden: we employ AI and predictive decision-making combined with just in time stop mechanisms to remove school-boy errors and to keep Clients safe governance-wise. User education is included, gone are manual calculations and relevant legislation is visible for all to learn along the way. Contractors and tenants input their own data, photos invoices etc... and systems are designed so that 2 job roles track each outcome to avoid single point of failure. Reports can be automatically scheduled for when you want them so you are never far from the data

Living Sectors PropTech: BTR Vertically integrated for Asset Managers

To drive returns at scale, data has to inform strategy: the granularity of the OpEx cannot be underestimated. Residential real estate is a Net Operating Income 'NOI' business model. Key KPIs include the rent collection rate, occupancy, voids, churn, average tenancy length, repairs recovery and more... Other strategies to deploy may include managing tenancy lengths to amortise 'move outs' over the year, queueing rent increases for the next tenancy, or making light work of deposit recovery. By simplifying transactions, guiding processes and automating ledgers and adopting your chart of accounts, teams can focus on driving rents, cost control and cost recovery to maximise the gross to net.

Some asset managers show a reluctance to deviate from their manual reporting approaches not Ringley! For an Asset Manager, data is arguably the king or queen of the land. The more one reaches under the hood to optimise the customer experience and leverage data such as reasons the viewing did not result in a let, the more one can feed the learning in and make calculated decisions that will safeguard against avoidable voids and losses in value.

Tech is an enabler, it saves time and money and releases the team's intellectual firepower to drive value. Ringley has been spending the last five years developing one of the most sophisticated tech platforms on the market. Arguably, we have automated every aspect of the operational process and connected to robotic accounting and provided unrivalled reporting systems, scheduling what you want, whenever you want.

Operations aside, many are still guilty of failing to appreciate that technology needs to be incorporated at every stage of the asset lifecycle. At the pre-construction stage that means tech-enabled site finding, financial modelling to support underwriting, local market analysis, and rent pricing, for example. The overall objective is an investment strategy shaped by a plethora of data points delivered through tech and those which ultimately feed into the value-add proposition.

Intuitive tech that blends the high-level and transactional views enables right 1st time and frictionless resident journeys, which in turn gives teams the bandwidth to unlock their human intuition. This is what unlocks the value of that tech in question. Performance indicators can only mean anything if they are interpreted by those with a tight grip on the nuances of the marketplace in which they sit and how they fit into the wider investment strategy, from design through to stabilisation and exit.

Ringley's techstack is the result of 20 years experience of managing residential real estate and covers everything from transactional leaseup, to the community experience, management of revenue and plant compliance.

Our Platform Joins All The Dots

PropTech: Vertically integrated

To drive returns at scale the data informs strategy, whether that be you have too many 'move outs' in July, or to automate processes such as renewals and rent arrears, or to set rent increases to queue for the next tenancy, or to make light work of deposit recovery. By simplifying transactions to guided decisions with automated ledger postings, teams can focus on driving rents, cost control and cost recovery to maximise the gross to net.

Rent pricing, pet rent and utilities management are part of what we do. Our techstack is agile and supports vertical integration by adopting the fund level chart of accounts to get rid of re-work on fund accounting and reporting.

Simply process & compliance

Compliant move in process

Know your risks immediately

see docs expring or due. Docs auto-email to landlords & tenants and queue in the welcome journey to send to the next residents.

Is our lifestyle App

We are the 'vertically integrated data people'

- Frictionless rental journey for residents, from finding a property to moving out.

- Our App generator portal creates lifestyle apps branded to your schemes to showcase all that is on offer. Build community, manage repairs, and calculate your Net Promoter Score.

- We share building safety with residents. They scan the QR code on the fire alarm or lift and can see maintenance records.

- Drive environmentally conscious living. Residents scan QR codes on appliances and connect to video-based home user guides, showcasing appliance energy efficiency features and how many trees can be saved.

- We start the conversation and foster a sense of community to reduce churn costs and reward those who stay.

- Amenity and event marketing tools and resident surveys are included.

- Vertical integration means less time collecting data, joining the dots and no re-work. Our living sectors platform tech is end-to-end not an array of off-the-shelf apps often with conflicting data structures!

- Over 100 KPIs included: rental growth, churn, demographics, viewing feedback, arrears, rent collection rate, repairs, deposit performance, OpEx, PPM, fire doors and fire risk assessment actions and more.... Most drill down to unit type.

- Our tech can reduce staff, it enables dual roles and drives staff efficiencies. It robots can do it (demands, allocations, bank recs, chasing arrears, marketing, viewing feedback, PPM), ours do. Our teams are leaner, and tech gives teams more time to drive community where a human face is needed most, e.g., front-of-house.

Operational Oversight - your end-to-end living sectors platform

-

Leasing

PlanetRent is so much more than Spike or Yardi Rent Cafe, Real Page or Qube. Four years of meticulous planning of each customer journey has removed all the rookie schoolboy errors and PlanetRent is a rules driven app that models each customer choice. This means the accounting is right first time, even if the customer changes their mind, switches units, varies their dates or decides to move out early.

-

Unit compliance

The risks dashboard in PlanetRent provides a snapshot of Gas Safe, ECIR, EPCs, HMO Licences due, expiring or missing. This makes it easy to ensure that unit compliance is kept up to date so that the lease up process is deskilled for front line staff on site who simply click to trigger an institutional quality welcome journey. And, should anything be missing meaning that it was not automatically triggered on letting or renewal to each resident then this shows on the New Lets Compliance Report so thr missing or expired doc can be uploaded which automatically will send at point of upload to the tenant(s), just like it would where a doc is renewed during the tenancy.

-

Tenant compliance

The risks dashboard in PlanetRent provides a snapshot of passports and visa to make it easy to know that Right to Rent checks are in order. These also show on the New Lets Compliance Report and during tenancy renewals so they cannot be forgotten.

-

Plant & Equipment compliance

Ringley's systems use QR code asset tagging to monitor the performance of plant and equipment, and if desired, white goods and furniture too.

The Planned Preventative Maintenance plan 'PPM' records in diary view what needs maintaining when linking to the relevant British Standard, as well as databasing recommendations so actions can be closed out.

Plant serial numbers are databased against QR codes as are specific fire doors. This powers inspection apps for site staff, fire door inspectors and contractors too.

-

Client monies & new lets compliance

To keep you safe governance-wise PlanetRent has APIs to Reposit our deposit alternative partner and TDS - the Tennacy Deposit Service.

The 'New lets compliance report' as well as returning TDS or Reposit registration numbers confirms other legal pitfalls have been complied with and that residents have been presented with:- EPCs

- Gas Safe certificates

- HMO licences

- ECIR certificates

- Relevant deposit scheme leaflet

- Government How to Rent guide

- Prescribed information

-

Revenue management

Our techstack uses AI to drive robotic accounting. Gone are the days rent memos, data input and accounting. We have eliminated or simplified the layers between teams and enabled open book accounting. To maximise collection we collect from residents individually but for debts treat them as jointly and severally liable.

Reporting can be scheduled inneditable excel form. Reports provide a rolling 12 month snapshot and separately identify each unique revenue stream as well as arrears collected, recovered from deposits or written off.

-

Community engagement

Our App generator platform creates a whitelabelled App for you. Your App will adopt your asset or portfolio branding and has modules to power events, booking amenities, bicycle hire, flat cleans, tuck shop, boiler servicing, fire door inspections, 121 and community chat and more... Everything can be reviewed with 4* and 5* reviews pushed to social media to build the brand.

-

Budgetary control

At Ringley the Operational Budget is linked to the Asset Register, rules ensure all plant is budgeted for and gets added to the Planned Preventative Maintenance plan 'PPM'. Real time variance reporting is a reality uniquely with Click through to individual invoices and instant ability to recode expenditure if necessary. The budget model adopts each Clients chart of accounts to power consolidated portfolio reporting.

-

CapEX management

Where the strategy is to 'exit' we will build a 10 year CapEx. For assets to be 'held' then by taking the quantity surveyors and mechanical and electrical engineers schedules we will build a lifecycle CapEx.

The asset level business plan will record the agreed relevant CapEx projects for the year for us to procure.

Together these are all accelerators. We generate you a Residents App branded to the building or your portfolio brand. Our Apps have modules to power events, book amenities, run bicycle hire, flat cleans, tuck shop, boiler servicing, fire door inspections, 121 and community chat and more... Everything can be reviewed with 4* and 5* reviews pushed to social media to build the brand. To build your brand we engage on-site teams and customers in designing every detail of each customer journey including staff and customer workshops.

& Mobilisation

This means that accounting is right the first time, even if the customer changes their mind, switches units, varies their dates or decides to move out early. New contracts and tenant substitutions are sorted in 2 clicks and no accounting expertise is required.

the Living Sectors

We can incorporate asset tagging (QR Codes) to monitor the performance of plant and equipment, and if desired, white goods and furniture too. A Compliance Offer is needed to watch the robots chase all the documents and to make light work of orders, then the staff on-site simply click to trigger an institutional quality welcome journey.

And, should anything be missing on letting or renewal, the New Lets Compliance Report and Dashboards show missing or expired docs, so they can be uploaded which automatically triggers them to be sent to the residents. For site staff, we power inspection apps for site staff, fire door inspectors and contractors too.

Together these are all accelerators. We generate you a Residents App branded to the building or your portfolio brand. Our Apps have modules to power events, book amenities, run bicycle hire, flat cleans, tuck shop, boiler servicing, fire door inspections, 121 and community chat and more... Everything can be reviewed with 4* and 5* reviews pushed to social media to build the brand. To build your brand we engage on-site teams and customers in designing every detail of each customer journey including staff and customer workshops.

This means that accounting is right the first time, even if the customer changes their mind, switches units, varies their dates or decides to move out early. New contracts and tenant substitutions are sorted in 2 clicks and no accounting expertise is required.

We can incorporate asset tagging (QR Codes) to monitor the performance of plant and equipment, and if desired, white goods and furniture too. A Compliance Offer is needed to watch the robots chase all the documents and to make light work of orders, then the staff on-site simply click to trigger an institutional quality welcome journey.

And, should anything be missing on letting or renewal, the New Lets Compliance Report and Dashboards show missing or expired docs, so they can be uploaded which automatically triggers them to be sent to the residents. For site staff, we power inspection apps for site staff, fire door inspectors and contractors too.

in the Living Sectors

The 'New lets compliance report' as well as returning TDS or Reposit registration numbers confirms other legal pitfalls have been complied with and that residents have been presented with: EPCs, ECIR certificates, Relevant deposit scheme leaflet, Government How to Rent guide, Prescribed information, HMO licences and Gas Safe certificates.

in the Living Sectors

Our revenue management tools show how rental performance by unit type, and enable analysis by void days, floor level, unit type, rent per sqft below average etc... Our rent review tools can increase rents at the touch of a button, new rents queue for the next re-let or renewal. Reports can be scheduled (pdf and excel) so you keep in touch with your data. And, you can build your own dashboards to suit. Budgetary control: At Ringley the OpEx and CapEx Budgets link to the Asset Register; system rules ensure all plant is budgeted for and populates the Planned Preventative Maintenance plan 'PPM'. Real-time variance reporting is a reality that lets you click through to individual invoices and instantly recode if necessary.

The budget model adopts each Clients chart of accounts to power consolidated portfolio reporting and spews out over 100 KPIs so is truly vertically integrated which can feed into the Asset Level Business Plan records the agreed relevant CapEx projects for the year. Being open API we can connect to any fund analysis platforms and strip out data re-work. We mine scope 2 carbon data to report on ESG strategies and demonstrate value for our clients, employees, and partners.

The 'New lets compliance report' as well as returning TDS or Reposit registration numbers confirms other legal pitfalls have been complied with and that residents have been presented with: EPCs, ECIR certificates, Relevant deposit scheme leaflet, Government How to Rent guide, Prescribed information, HMO licences and Gas Safe certificates.

in the Living Sectors

Our revenue management tools show how rental performance by unit type, and enable analysis by void days, floor level, unit type, rent per sqft below average etc... Our rent review tools can increase rents at the touch of a button, new rents queue for the next re-let or renewal. Reports can be scheduled (pdf and excel) so you keep in touch with your data. And, you can build your own dashboards to suit. Budgetary control: At Ringley the OpEx and CapEx Budgets link to the Asset Register; system rules ensure all plant is budgeted for and populates the Planned Preventative Maintenance plan 'PPM'. Real-time variance reporting is a reality that lets you click through to individual invoices and instantly recode if necessary.

The budget model adopts each Clients chart of accounts to power consolidated portfolio reporting and spews out over 100 KPIs so is truly vertically integrated which can feed into the Asset Level Business Plan records the agreed relevant CapEx projects for the year. Being open API we can connect to any fund analysis platforms and strip out data re-work. We mine scope 2 carbon data to report on ESG strategies and demonstrate value for our clients, employees, and partners.

PropTech to Asset Manage UK Build to Rent

Living Sectors PropTech: BTR Vertically integrated for Asset Managers

Some asset managers show a reluctance to deviate from their manual reporting approaches not Ringley! For an Asset Manager, data is arguably the king or queen of the land. The more one reaches under the hood to optimise the customer experience and leverage data such as reasons the viewing did not result in a let, the more one can feed the learning in and make calculated decisions that will safeguard against avoidable voids and losses in value.

Operations aside, many are still guilty of failing to appreciate that technology needs to be incorporated at every stage of the asset lifecycle. At the pre-construction stage that means tech-enabled site finding, financial modelling to support underwriting, local market analysis, and rent pricing, for example. The overall objective is an investment strategy shaped by a plethora of data points delivered through tech and those which ultimately feed into the value-add proposition.

Intuitive tech that blends the high-level and transactional views enables right 1st time and frictionless resident journeys, which in turn gives teams the bandwidth to unlock their human intuition. This is what unlocks the value of that tech in question. Performance indicators can only mean anything if they are interpreted by those with a tight grip on the nuances of the marketplace in which they sit and how they fit into the wider investment strategy, from design through to stabilisation and exit.