As leases will continue to get shorter and most issue themselves new long leases on completion.

How to buy the freehold of your block of flats

Clubbing together to buy the Freehold of your block has been a legal right to qualifying leaseholders* since 1993. As leases get shorter over time, post enfranchisement new freehold members usually grant themselves new long leases.

Getting started Collective Enfranchisement

(Freehold Purchase)

Collectively buying the Freehold of your block has been a legal right to qualifying leaseholders* since 1993. Leases will continue to get shorter and collective enfranchisement is one solution, if you cannot get the requisite majority on board claiming your statutory right for a lease extension would be another.

Owning a flat only gives you rights of occupancy for the term of the lease. When your lease eventually expires your flat reverts to the Freeholder.

If you own a share in the freehold then at the end of your lease the flat reverts to the Freehold owning company not to you individually. But, normally most Freehold Companies have a board meeting and vote that all shareholders be allowed to extend their leases to 999 year leases. This should be done via a formal Board resolution to "permit any lessee with a share in the Freehold to extend their leases at Nil premium".

Sometimes granting new 999 year leases is executed at the time of the actual freehold purchase transaction for convenience, but it need not be so. If you need to keep costs down this can be done later. After all a short lease is only a problem when perhaps you are selling or remortgaging and a mortgage lender has a policy that they will not advance the normal loan to value ratio if the lease has say less than 60 years unexpired.

It is getting easier

Increasingly legislation has been changing to benefit the leaseholder who wants to enfranchise. For example qualification criteria have been relaxed and it is no longer necessary to live in the flat.

Exercising the right requires a formal legal notice to be served on the Freeholder and all intermediate landlords.

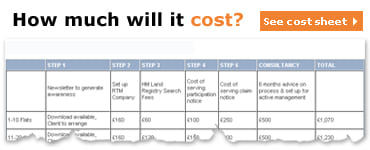

Here the Leasehold Guidance Service provides a step-by-step guide to Buying Your Freehold.

Step 1

What's in a Freehold Enfranchisement Valuation?

- Understanding valuation science

- Preparing for the valuation

- Cases where there is an intermediate landlord

Step 2

- Serve your Freehold Purchase Claim Notice

Step 3

- Advice on negotiations

- Advice on going to a First Tier Tribunal

- Understanding Tribunal procedure

Step 4

- Complete Legal Work

- Setting up the Freehold Company

Step 5

- Consider Granting New 999 Year Leases

- Block Management options beyond the freehold purchase

Freehold Purchase: our experts answer your questions

198

Clubbing together to buy the Freehold of your block has been a legal right to qualifying leaseholders* since 1993.

Collectively buying the Freehold of your block has been a legal right to qualifying leaseholders* since 1993. Leases will continue to get shorter and collective enfranchisement is one solution, if you cannot get the requisite majority on board claiming your statutory right for a lease extension would be another.

Owning a flat only gives you rights of occupancy for the term of the lease. When your lease eventually expires your flat reverts to the Freeholder.

If you own a share in the freehold then at the end of your lease the flat reverts to the Freehold owning company not to you individually. But, normally most Freehold Companys have a board meeting and vote that all shareholders be allowed to extend their leases to 999 year leases. This should be done via a formal Board resolution to "permit any lessee with a share in the Freehold to extend their leases at Nil premium".

Sometimes granting new 999 year leases is executed at the time of the actual freehold purchase transaction for convenience, but it need not be so. If you need to keep costs down this can be done later. After all a short lease is only a problem when perhaps you are selling or remortgaging and a mortgage lender has a policy that they will not advance the normal loan to value ratio if the lease has say less than 60 years unexpired.

Increasingly legislation has been changing to benefit the leaseholder who wants to enfranchise. For example qualification criteria have been relaxed and it is no longer necessary to live in the flat.

Exercising the right requires a formal legal notice to be served on the Freeholder and all intermediate landlords.

Here the Leasehold Guidance Service provides a step-by-step guide to Buying Your Freehold.

-

What's in a Freehold Enfranchisement Valuation?

To get your head around this you need to understand that whilst each lease is valuable to its leaseholder today, at whatever it could be sold for in the market place, each lease is also valuable to the Freeholder who

- receives investment income from it (the ground rent)

- has the hope value of a premium from you (for buying a lease extension)

- holds the reversionary interest (the value of a vacant flat in XX years time)

- probably makes commission from placing insurance on the block

- may have unleashed development potential (roof spaces, rights to build over garage blocks, dis-used air raid shelters capable of development)

This is a specialist area of valuation that needs some understanding as the valuation methodology involves the following elements:

- Market values of the flat for flats with less than 80 years unexpired on the basis of

- a short lease with ground rents payable as covenanted under the lease

- a long lease with peppercorn ground rent payable

- The value of the landlord's interest

- ground rent receivable as covenanted under the lease

- present value of the reversionary title (a vacant flat) at the end of the lease

- Marriage value ie, the difference between (a) and (b) above

- The value of any appurtenant property (other interests owned by the freeholder in the Freehold title that are not already demised to lessees, i.e., garages, attic space, land)

- The value of any other income, insurance commissions etc...

-

Understanding valuation science

The science of valuation enables us to calculate the "present value" of the future right to your vacant flat and enables us to value the ground rent (an income stream for a term of years.

The valuer will consider market evidence and settled caselaw to select the appropriate capitalization rate upon which to base our valuation of the ground rent. In simple terms this could be a rate derived from or comparables such as gilts yields (gilts are government bonds), interest rates paid on bank credit balances, the bank base rate and a premium for the perceived risk of investing in property etc .

He/she will select the appropriate deferment rate by which it is reflected that the reversionary value to the landlord is some years away.

There are arguments that the capitalization rate for ground rent payable to an intermediate landlord should be capitalized at a different rate to ground rent payable to a Freeholder. We can talk you through such arguments, but essentially it all relates to the perceived quality of each as a provider of investment income.

The valuers will draw from market evidence and settled caselaw the improvement rate which is the percentage by which the value of the flat would increase from being granted a statutory 90 year lease extension. This is subjective and probably the most argued point at First Tier Tribunal. Negotiation factors will be the length of the lease unexpired lease as opposed to the length of a typical lease in the area. For example, in Knightsbridge where short leases are common place it could be argued that the improvement rate would be less than where short leases are uncommon.

Remember, since July 2003, the improvement rate is 0% if your lease has more than 80 years unexpired! This means you compensate the Freeholder for the loss of ground rent but do not have to pay marriage value.

For Enfranchisement application the valuer also has to assess the any development rights in the property. This requires an understanding of:

- development potential and development costs (build costs, building regulations ie, is a top floor walk up flat actually possible without provision for a secondary means of escape),

- planning densities for the area, borough, planning prescedents locally and likelihood of a planning consent being forthcoming to increase the amount of accommodation built on the site.

- what is "demised" to the lessees and what of value is still vested in the Freehold title

- what is "allocated" and what the permitted use is. For example if a roof space is allocated for storage purposes, a collective enfranchisement application may release it for potential development.

-

Preparing for the valuation

We need:

- to build an understanding of how many types of lease there are at the block, in an ideal world all flats would have been sold off on or around the same time and therefore leases would all start on the same date and be for the same number of years, with ground rent typically varying depending on the size of the unit. However, we have been involved in scenarios where there are up to 10 different types of leases, together with other complications such as garages on separate titles with varying ground rents payable also.

- A copy of each lease type as this will set out the ground rents covenanted during the term (unless all leases are the same). From the lease we will derive the ground rents covenanted during the term (it is common for the ground rent you pay today to rise as the lease gets shorter). For larger sites where ground rent varies from flat to flat a schedule of ground rents and review dates/amounts is helpful.

- To inspect most flats and understand the context of the building in which they are situated, for flats we cannot get access to we will request sight of the lease plan to clarify the layout. Without doing so it would be impossible to carry out the marriage value part of the valuation

- The Leasehold Guidance Service is part of the Ringley Chartered Surveyors (http://www.ringley.co.uk) therefore a Chartered Surveyor will carry out the valuation for you

- comparable evidence to support our opinions

- analysis of how we select the investment yield

- recent court decisions re: marriage value (the difference in value between a short lease and a virtual freehold)

- advice on what you should serve as the price on your initial notice

Our valuation report includes a full commentary on

-

Cases where there is an intermediate landlord

Where due to an intermediate interest such as a headlease we have to consider additional valuation factors under paragraph 8(1) of Schedule 13, or paragraph 8(3) such as where an intermediate interest receives a profit in ground rent or has a reversionary interest of more than 5 days it may be required to be valued as a wasting asset which would according to case law require a sinking fund and tax to be allowed for. Valuing an intermediate interest adds to our standard fee structures.

Our fees reflect the amount of research necessary to fulfill the valuation methodology set down in law and to enable us to provide you with not only a valuation but elemental reasoning behind each part. From all this we are able to piece together the eventual "valuation" "premium that should be paid"

Where development rights are considered complex and involve liaison with architects, carrying out planning research, research as to build costs etc . Then a supplemental fee will be payable on a time basis. An indication will be provided to you prior to proceeding with such additional work.

The leaseholder claiming his rights is the party that in law is responsible for both parties costs and it is my understanding that if the residents have served Notice then the Landlord's surveyors fees form part of the purchase price together with reasonable legal fees.

-

Serve Notice

Should I serve a Notice or open informal discussions?

A difficult question!

Some Freeholders will quite rightly refuse to entertain discussions without a formal notice. From the Freeholders perspective, without formal notice he/she is at risk for fees to cover professional advice they need to negotiate with you.

That being said, if your freeholder lives in the block it would be better to have a chat first. Strangely some freeholders still need educating that it is a leaseholders right to buy him or her out.

Exercising the right requires a formal legal notice to be served on the Freeholder and all* intermediate landlords. In claiming your statutory right the compensation to which a Freeholder is entitled will include any appurteunt property, possible retained land with development rights (a roof space) perhaps, loss of investment income, loss of commission from insurance premiums.

Serving Notice invokes statutory timescales for response. Errors in a notice may result in the freehold purchase being completed at the price stated by the party whose notice is not legally flawed.

Understanding what "premium" you should quote on your notice requires specialist valuation advice. The leaseholder claiming his/her rights is the party that in law is responsible for both parties costs and it is our understanding that if the residents have served Notice then the Landlord's surveyors fees form part of the purchase price together with reasonable legal fees.

Understanding what you should offer will require you to take specialist valuation advice. There are rather more factors in a collective enfranchisement valuation for say a block of 30 flats than perhaps 30 typical mortgage valuations. Primarily this is because the valuation methodology is set in statute and secondly because there is an element of assessing compensation due to the landlord and intermediate interests for dispossessing them of valuable title.

-

Advice on negotiations

Whilst our valuations do include evidence, a valuation commentary, advice on what to serve on your initial notice/counter notice, should you not be able to close the deal we can negotiate valuation differences on your behalf.

Negotiation are carried out by a Director or FRICS qualified Surveyor and are chargeable on an hourly rate. We would usually give you a time/cost initial budget based on the complexities perceived in the case in question. We would account our time to you if negotiations are not concluded within this initial budget.

Where it becomes apparent that not all valuation parameters can be agreed outside of the First Tier Tribunal a synopsis of what it is recommended that can be agreed prior to a hearing will be advised to you.

-

Advice on going to a First Tier Tribunal

If negotiations fail to be fruitful then we can lodge an application to the First Tier Tribunal for a determination. Lodging an application costs in the region of £350. You will also be responsible for the costs of representation at the hearing this will be based on an hourly rate for a Director or FRICS qualified Surveyor.

To present a case a First Tier Tribunal careful evidential preparation is required. The extent of work depends on which facts have been agreed through negotiation (it is unusual to attend FTT to negotiate everything). This could involve scouring all local sales, obtaining land registry copy entries to confirm lease details, then seeking confirmation about accommodation, unit layout/size an getting floor plans and condition details from estate agents or door to door based research. This may take perhaps 1-2 days. Negotiations would continue up to the hearing with the intent of agreeing as many facets of the valuation as possible to keep the hearing relatively simple.

-

Understanding Tribunal procedure

After lodging your application your case will be allocated a case reference number and listed for a pre-trial review. At pre-trial review the tribunal will make directions on what evidence they want to hear and set timescales against which the case is to be conducted.

Our attendance at the pre-trial review is not essential but often this is a good time when face to face negotiations can take place with the other side to agree any facts that can be agreed and agree what cannot be agreed between the parties. This assists all concerned in which areas to focus the evidential part of the hearing day on. For example, it could be that yields become agreed but that the value of the flat is what is referred to the First Tier Tribunal for determination.

The cost of presenting a case at First Tier Tribunal depends on the number of days the case is listed for and what can be agreed between valuers in the period running up to the case.

As a leaseholder you could represent yourself should you choose to do so. As a Leaseholder you are at risk for your professional costs, the application costs and the Freeholder costs. As a Freeholder professional advice flowing from a valid Notice claiming a lease extension is to be compensated to you as part of the Lease Extension rights.

As an enfranchising residents committee you could represent yourself should you choose to do so. As a group of residents you are at risk for your professional costs, the application costs and the Freeholder costs. As a Freeholder professional advice flowing from a valid Notice claiming a lease extension is to be compensated to you as part of the Lease Extension rights.

-

Complete Legal Work

This is a specialist area of law that many high street solicitors do not practice in.

If the timescales required for the various stages are not adhered to or the specified matters are not disclosed on a Notice then the Notice can be invalid to the detriment of one or other party.

-

Setting up the Freehold Company

There is a need to set up a Freehold Company through which the Freehold once transferred is owned. This company should reasonably represent the objectives of a company that only manages and owns a freehold title. We therefore do not recommend that you buy a company "off the shelf".

The articles of association are simplified for future meeting requirements and the objectives of the company tailored to running estates.

- Obtaining a copy of the lease(s)

- Obtaining a copy of the Land Registry Title Numbers for leasehold and Freehold titles

- Checking leaseholders' eligibility to qualify/participate in the Freehold Enfranchisement application

- Serving information notices to trace the Freeholder/Competent Landlord

- Forming a company in which to buy the Freehold title

- Serving Notices to Enfranchise

- (a) On the Freeholder/Competent landlord(s), there may be an intermediate landlord

- (b) Via a Vesting Order where the landlord cannot be found

- (c) Via the Trustee in Bankruptcy where landlord is an individual who is bankrupt

- (d) Via the Receiver where landlord is a company in receivership

- Dealing with Landlord's requests for a deposit to be paid. By law this can be 10% of the premium or £250 whichever is the greater

- Conveyancing to vest the title in the Freehold Company

- Issuing Share certificates to participating lessees

- Executing a Deeds of Variation to vary the term (length of the leases) to make the term up to 999 years

- Advising on or considering other terms that variation would have benefit to one or both parties

- Handling Client monies and paying the premium to the landlord

- Registering the Freehold title in the Freehold Company at Land Registry

- Registering all Deed of Variations in the Freehold Company at Land Registry

- Obtaining Mortgagees (mortgage company's consent) to such registration of a Deed of Variations

- Witnessing any deeds or discharge forms required by mortgage companies to enable registration that your lease has been extended with the Land Registry

- Lodging a case with the First Tier Tribunal where terms cannot be agreed

The legal work necessary to complete a lease extension includes:

-

Consider Granting New 999 Year Leases

Granting new 999 year leases may be strategically incorporated into the Freehold purchase if there are reasons why you would want everyone at the site to have new leases, ie, if principal terms need varying, for example if there is no interest clause (no incentive to pay service charge promptly)

If more fundamental changes are require a complete modern lease could be substituted.

It should be noted in law that a lease variation of substitution cannot be forced on a party it has to be mutually consented to. However, if the resolution to grant new leases on x, y, z terms is approved by a Board of Directors it is only this type of lease/deed of variation that is available, until an alternative is approved.

A freehold shareholder cannot be forced to take this type of lease/varied lease and would be bound by the original lease until such time as they chose to participate. A clear incentive would be the ground rent reduction to a peppercorn.

-

Going Forwards

Other considerations when we become freehold shareholders.

Once the Freehold is acquired, you may require further assistance with building works, legal aspects, company formation, company constitutional issues and/or the day-to-day management of the property.

198

The key to our success is our people.

LEE HARLE

Senior Partner Law

Richard Read

Head of Block Management

Wales & West

Nick Pratt

National Head of Site Staff

Block Management

Nick Pratt

National Head of Site Staff

Block Management

Our Right to Manage Experts

The key to our success is our people