Students prefer PBSAs to traditional, often substandard, landlord-run residences.

Demand for Purpose Built Student Accommodation (PBSA) continues to grow: our student beds requirement (undergraduates and post grads) is just shy of 1 million beds. The continued 'flight to excellence in design and operations continues.

Arguments for investing in student housing

UK government policy is pro international students who account for 20.7 percent of the student population, 14.9 percent of all undergraduate students, and 37.1 percent of all postgraduate students. The UK government aim to increase this to 600,000 per year by 2030, albeit there is now a curb on dependent family visas.

In terms of UK student demand the opportunity for PBSA investment is to address excess demand by providing a better product at a competitive price. Some 47% of student beds are operated by the private sector with the balance managed by the universities.

Demand for UK purpose built student housing

HESA data confirms that demand for student housing in the UK continues to rise. Both undergraduate and post grad Non-EU intakes have increased which has compensated for the drop in EU intakes.

The discerning student

Students prefer purpose built student accommodation ‘PBSA’ to traditional, less well maintained private landlord-run rooms; the result is a continued 'flight to excellence.'

Domestic student demand is at an all-time high, not only is private rental sector (PRS) and HMO stock limited, but there is a clear demand preference for larger community-focussed purpose-built well-maintained stock student housing. Service-included is key, students want 24-hour on-tap lifestyle, and responsive maintenance; those that don't provide it risk losing residents

Student housing investment challenges

Where to invest: The play is to look at stock in the planning pipeline, the age of existing stock, and for cities with a strong increase in student admissions which will be suffering from high student-to-bed ratios.

PBSA is counter-cyclical: Student housing (PBSA) continues to be counter-cyclical, with student numbers increasing during economic uncertainty.

Land for PBSA development: For non-platform buyers' market concentration has reduced options and the play has shifted towards development, a need to partner with developers. Access to suitable building sites is competitive, with developers of multi-family housing and logistics often also in pursuit.

PBSA Build viability: Construction cost inflation continues to influence viability; rising material costs, energy prices and labour shortages all have played their part. Only good control over supply chains can mitigate these risks.

PBSA sector track record: The PBSA sector has a proven track record of revenue generation and a fundamentally solid demand outlook. Success will depend on an operator who is expert in running a ‘net operating income’ business model. Funds are looking for core or above-core returns, but there are few operators.

International students have historically been over-represented in the PBSA, further fuelling robust growth with strong demand continuing.

The ‘One Stop Shop’ Student Housing Operator

Given the increased demand for low-cost, but not for low-spec student beds, Ringley’s living sectors delivery platform Una Living has established an integrated asset, leasing and student management model. Una Living provides an end-to-end solution for asset owners, institutional investors, real estate investment managers, overseas funds, family offices, landlords in education and creates value through strategic partnerships. Our vertically integrated living sectors platform is geared to create OpEx efficiencies and to enhance the blended IRR.

Site finding:

Student towns rise and fall in terms of popularity, so watching the trends is key to support long term investment.

The Underwrite:

It starts with a market insights report, competitor analysis and modelling the gross to net....

Planning & Project Monitoring:

The brief, the shortlist of consultants, the ESG Agenda, built snagging and handover.

Management of Stabilised PBSA Stock:

Student housing management brings together the disciplines of leasing, stakeholder engagement and nomination agreements, hospitality, facilities management, revenue management and property management.

Smart Lease up

We prepare a local market report, study competitor product and base rents. Then, we add the rent premium for ESG, views and amenities. Demographic analysis informs social media groups so we can start to build the buzz. Lease-up starts 6-9 months ahead of the academic year.

PBSA Mobilisation

Mobilising student beds includes all the usual furniture packs, cause and effect testing of plant, but also includes nomination agreements, early staff recruitment and dry run training to deal with mass move in for September.

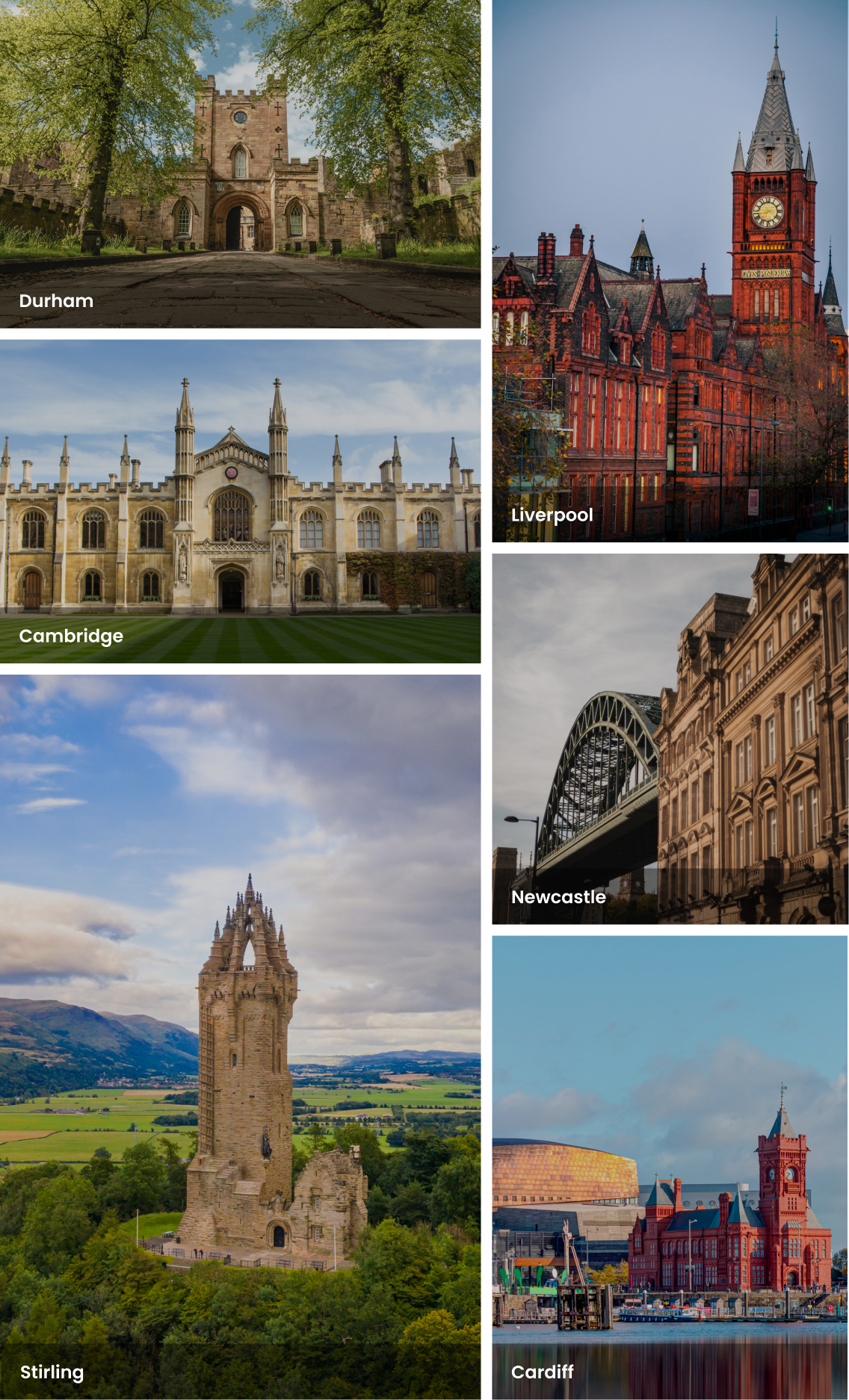

Tier 1 cities for student housing

Tier 1 cities with strong increases in student numbers, high student-to-bed ratios, and/or restricted pipelines continue to have a high need for additional housing. Bristol has ascended to the top tier: it has a healthy pipeline, yet supply shortages mean still some students are forced to live in Bath.

ESG - ‘E’ Enviromental

ESG - ‘S’ Social Value

ESG - ‘G’ Governance

PBSA List of Tier 2 Cities

The higher and lower second-tier cities have high demand scores as well, although they usually have greater stock and/or larger pipelines.

Our Asset Management Leaders

The key to our success is our people