Our Commercial Property Management Team

Our Asset Management Leaders

The key to our success is our people

Phillip Michael

phillip.michael@ringley.co.ukIndustrial Sheds & logistics

Whether it is fulfilment centres, advanced manufacturing, technology parks, multi-tenanted spaces and last mile distribution hubs, occupier needs continue to evolve. With the gap widening between Clients needs and available stock our focus is to create the best possible relationship between Client and occupier to maximise occupier satisfaction.

Samuel May

sam.may@ringley.co.ukRetail: town centre & retail parks

As the pace of change in consumer retail trends increases destination marketing is ever more entwined in driving footfall and achieving retail success. Local market intelligence together with deep insights is key to identifying and capitalizing on opportunities to drive consumer footfall and ultimately asset values.

Joshua O'Rawe

josh.orawe@ringley.co.ukMixed Use Schemes

Whilst retail used to drive town centres, now mixing uses (residential, student, build to rent and later living) is the key to re-purposing our town centres nationwide. We coordinate master-planning, placemaking, estate management, design for operations, and manage stakeholders. To make a space a place, we blend consumer and residents viewpoints, brand it, then package the opportunity to would-be occupiers.

Eric Asare

eric@camdengateway.co.ukCo-Working Communities

Join our vibrant start-up Co-Working community in London’s ever trendy Camden Town, NW1. Camden Gateway, is bright and airy and filled with greenery too. It is a strong community a place where people come together with common purpose to grow their start-up and achieve. You can Co-Work or hot desk with us. Grow into a private office or take a suite for a small team.

Andrea Efstathiou

andrea.efstathiou@ringley.co.ukOffice

The way we work is changing: this affects our Clients investment strategies as much as would-be occupiers. Modern office spaces are as much about networking and social interaction as desks. Occupiers no longer match desks to headcount, booking a desk is not unusual. We help Clients adapt and occupiers find places where staff can come together to be inspired, solve problems faster, showcase projects, and get deals done. We support investors strategy, and help occupiers find workplaces to meet todays demands attract talent.

We run rolling refurbishment programmes of offices, retail shells, common parts and building plant.

Where necessary, we will work with occupiers to source and support moves to interim accommodation, and work to incorporate their needs in fitting out to support their transition in working practices ahead of reoccupation

Refurbishment Programmes

We run rolling refurbishment programmes of offices, retail shells, common parts and building plant.

Where necessary, we will work with occupiers to source and support moves to interim accommodation, and work to incorporate their needs in fitting out to support their transition in working practices ahead of reoccupation.

As well as gamifying sustainability through our Occupier SmartPhone Apps, our teams will track the ESG of your assets and are ready with data to support your next lending application or acquisition.

We favour ‘green design’, to WELL building standards that create social value, given environmental impact and sustainability is ever more important for all stakeholders: asset owners, occupiers and their employees.

Commercial Asset Management Reporting

We understand asset owners and investment managers run their own investment analytics, so our tech stack is open API and can deliver information in csv or API format to Horizon, Qube or other software of your choice.

Beyond accounting

Our role is to work alongside Clients’ Asset and Finance Teams, to report what you need your way, instantly and to give you access to real-time data so you can drill deeper and understand the costs and trends.

Trend reporting: the big data

We analyse the assets we manage from each of our specialist perspectives; trend reporting and our data driven approach enables us to do this.

Risk Management

Old school commercial asset managers using outdated systems like RiskWise, Prisms or others often fail to connect the facets of risk management. Our approach goes beyond risk managing the PPM to connect and improve the budget and track that recommendations databased result in not only a Works Order but an invoice for what is required. We are audited internally and externally to ISO45001, the international standard for occupational health and safety.

Plant items

We create the Asset Register, build the preventative maintenance diary, collect the reports, database recommendations and audit trail getting works done.

Budget

Our budgets link to the Asset Register inextricably linking financial and compliance management. With us you are never more than 2 clicks away from an invoice or supporting documentation.

Spending

With us you can track spending to budget in realtime and effortlessly drill down from portfolio level to individual property to each transaction.

Client portal

If you find it hard to get reporting from your current Manager, can't get the numbers you need or find that your time is wasted checking-up and checking-in, then there is another way. We will deliver the reporting you need, and automatically send it to email you when you want it.

Occupier SmartPhone App

We own an App generator portal and can brand, build and create an Occupier SmartPhone App that is tailored to the services in your building.

Occupier satisfaction

Put simply, because occupier satisfaction matters to us, we track it. Who wouldn’t?

We use the Net Promoter Score ‘NPS’ model to check that, on balance, occupiers would recommend us. Integration of Occupier Smart

Transition: Our problem not yours

Our Analaysts will make light work of transition, can carry out management audits, we can get aged outstanding service charge accounts completed at speed and investigate balance sheet items to put things right. Challenge us:

Visible property and facilities management

To add value, we are acutely aware that the asset management and services we provide must enhance the occupier and visitor experience.

Asset Management

Good asset management is about being able to see what others do not, this starts as early as the transition phase.

Stakeholder Engagement

To add value, we are acutely aware that the asset management and services we provide must enhance the occupier and visitor experience.

Managing a change on-site

Good asset management is about being able to see what others do not, this starts as early as the transition phase.

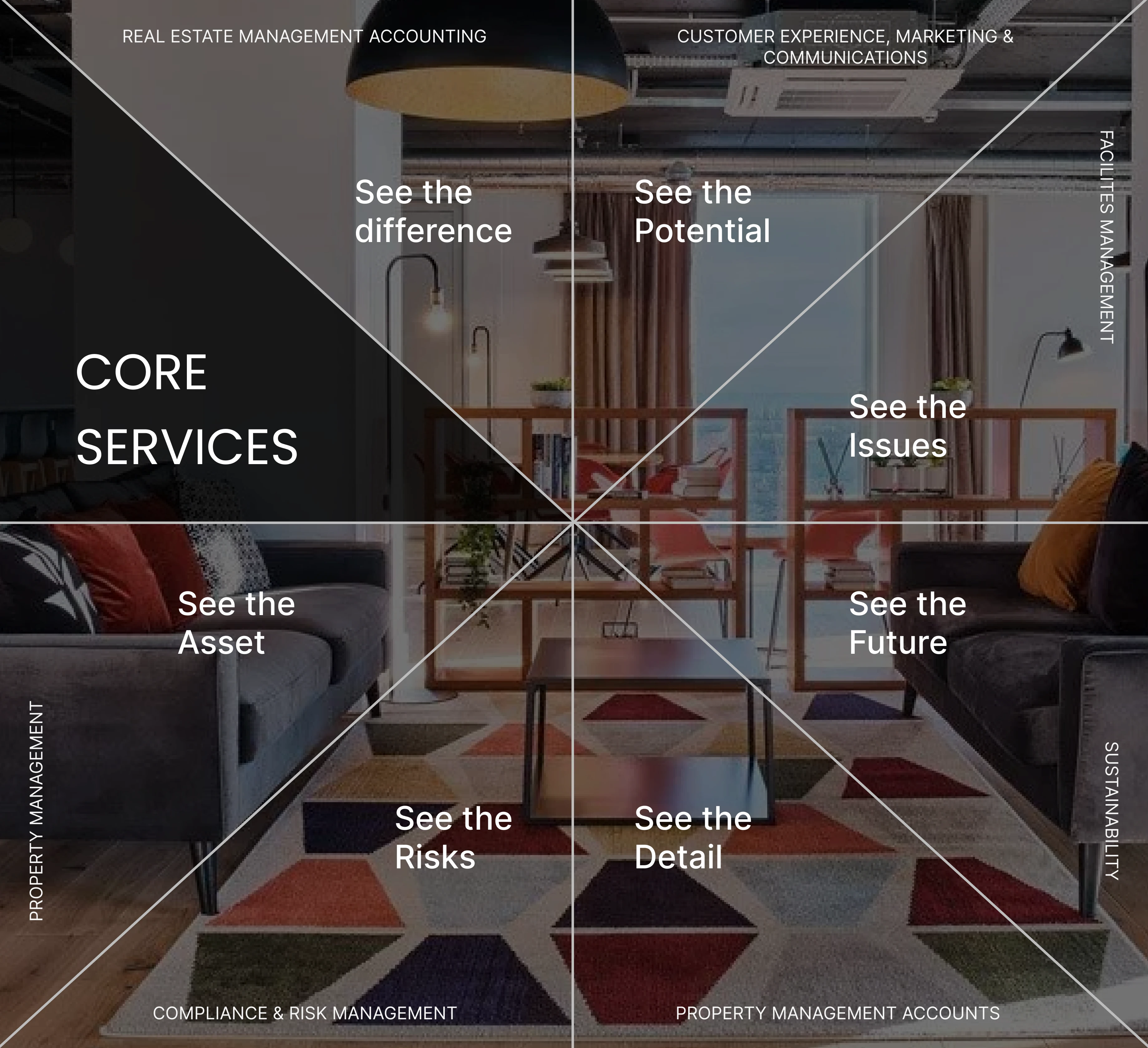

Our Philosophy

Our guiding principle is to be perceptive; to see what others do not.

Our aim is to analyse the assets we manage from each of our specialist perspectives to ensure we observe and notice the insights, data, issues and potential that will have a real impact of out client and their occupiers. By creating manageable priorities and actions, we formulate a robust roadmap to tackle as part of your wider business plan.

your asset

the risks

the potential

the detail

the issues

the future

Introducing our Commercial Asset Management Team

We are ready:

Your dedicated commercial asset management team are ready to transition your properties into unrivalled transparency, and to start evaluating opportunities to drive income, improve service, modernise workspaces, match trends, scrutinise operating costs, and engage with occupiers ultimately to deliver assets that outperform the peers in their class.

We are truly connected using our own bespoke end to end integrated technology platform which links budgets, compliance and SmartPhone Apps. We are vertically integrated from acquisition to disposal: our offering spans rent, ground rent and service charge across multiple sectors from daily co-working lets to occupational leases, and residential too.

With Ringley, finance and risk are inextricably linked, this expertly designed platform and connectivity goes beyond managing the PPM.

Mary-anne Bowring

Group Managing Director

Mary-Anne Bowring as Group MD has taken Ringley from a start-up to employing over 200 people and achieving the prestigious Investors in People GOLD Standard. Under her leadership, The Ringley Group has harnessed technology to add value to all living sectors: build-to-rent and institutional block management, e.g., the Europa, Abrdn, Patrizia and others. She set up Work by Ringley, c200 workspaces in Camden Town, and invested in digital disrupters 'Virgin Land' whose digital platform sources land for developers large and small.

Mary-anne Bowring

Group Managing Director

Richard Williams

CEO

Richard is Group CEO of The Ringley Group; formerly MD of Property Management and Board member at both CBRE & Avison Young. Richard is market facing, responsible for strategic partnerships and growth, as well as establishing Ringley's position in the commercial asset and property management arena.

Richard Williams

CEO

Sabuj Sarkar

BTR Relationship Director

Sabuj Sarkar joins as BTR Relationship Director to drive our BTR platform, Una Living and Una Consult. He brings operational experience of multi-family build to rent, coliving, student. Sabuj adds value throughout the entire life cycle, from design concept, contractor relations, mobilisation, staffing structures, training, procedures, lease up and retention strategies.

Sabuj Sarkar

BTR Relationship Director

Oliver Hopkins

Investment Director

As Investment Director Oliver works the capital markets specializing in acquisitions and disposals in the living sector.

Oliver Hopkins

Investment Director

Risk Management

Old school commercial asset managers using outdated systems like RiskWise, Prisms or others often fail to connect the facets of risk management. Our approach goes beyond risk managing the PPM to connect and improve the budget and track that recommendations databased result in not only a Works Order but an invoice for what is required. We are audited internally and externally to ISO45001, the international standard for occupational health and safety.

Plant items

We create the Asset Register, build the preventative maintenance diary, collect the reports, database recommendations and audit trail getting works done.

Budget

Our budgets link to the Asset Register inextricably linking financial and compliance management. With us you are never more than 2 clicks away from an invoice or supporting documentation.

Spending

With us you can track spending to budget in realtime and effortlessly drill down from portfolio level to individual property to each transaction.

CORE

SERVICES

Our property management and accounting services are well established, but our core services extend beyond this and present more than meets the eye. We serve an impressive client portfolio and are responsible for the satisfaction, retention and acquisition of occupiers across diverse property types. Our people share office space, information and contacts to ensure you receive agile responses and service excellence.

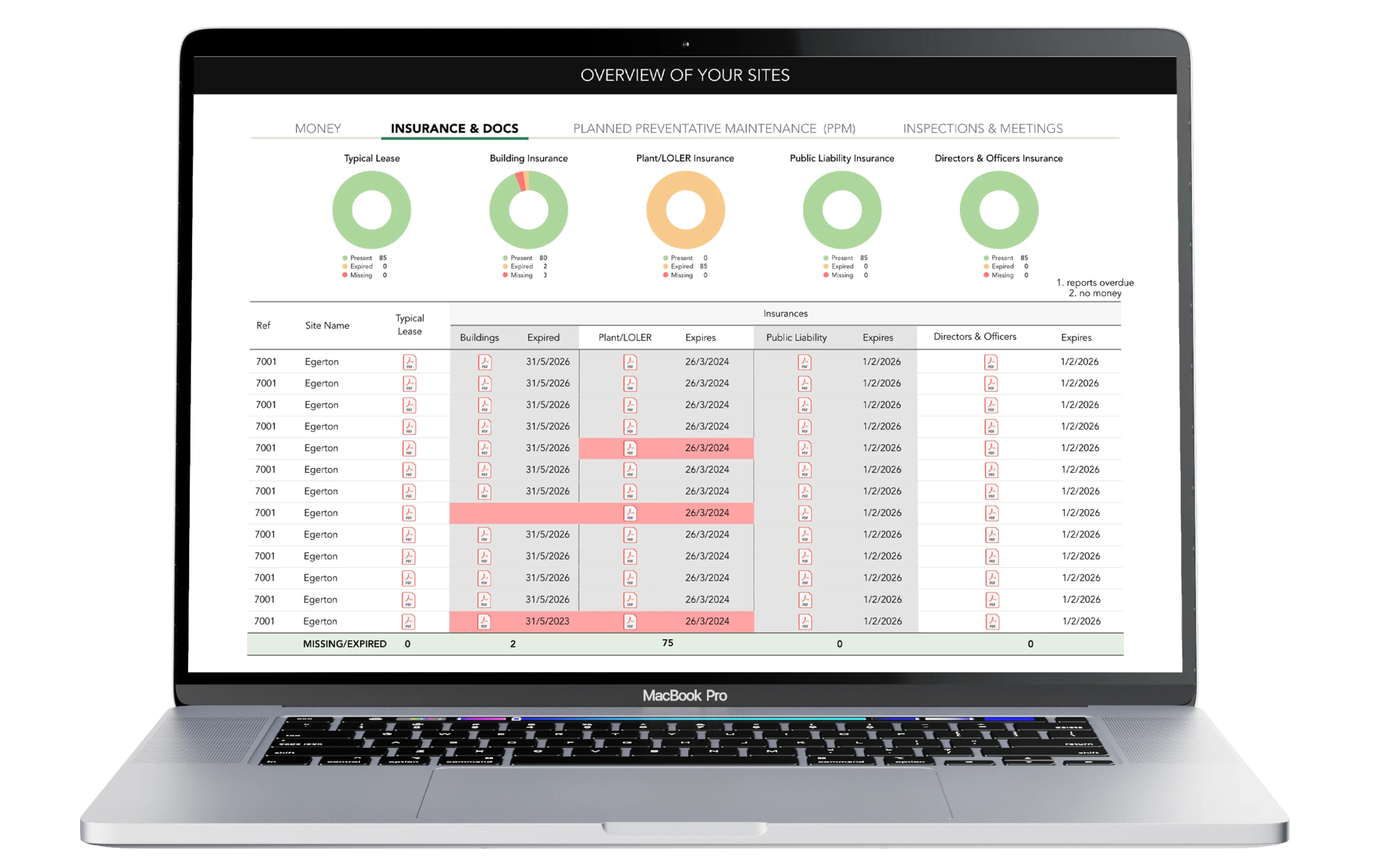

If you find it hard to get reporting from your current Manager, can't get the numbers you need or find that your time is wasted checking-up and checking-in, then there is another way. We will deliver the reporting you need, and automatically send it to email you when you want it. This can be by single asset or aggregated reporting across a portfolio of assets. We live our brand promise of 100% transparency, unlike other commercial asset managers, our Clients get a portal with a dashboard that covers:

- Rent & other income collected

- Planned Property Maintenance

- Service Charge budget, spent and invoices

- Occupier Compliance matters

- Fire Risk matters

- Inspection reports

All Clients are never more than 2 clicks away from, rent and service charge statements, budgets, and invoices, the PPM Diary and compliance dashboard, fire risk matters and health and safety inspection reports.

Portfolio Clients can drill through their portfolio, and, our portal highlights where the numbers are not below par, to drive the conversation and show you what we are focusing on.

Occupier SmartPhone App

We own an App generator portal and can brand, build and create an Occupier SmartPhone App that is tailored to the services in your building. Our SmartPhone App’s offer more than just a way to report repairs, message reception, message the facilities manager, they offer interest based chat channels, can publisise events such as charity bake days across multiple occupiers to build social networks, as well as enable occupiers to upload their profile and chat 121 and in groups to connect, find lunch dates and more….

The SmartPhone App also deals with parcel management and teams can use parcel notifications to get parcels collected and keep reception clear. For smart buildings the SmartPhone App can also be used as a way to share sustainability data to drive occupier behaviour, by gamifying energy use to recognise and covet eco-heros to engage all, whilst at home and at work, in the goal to edge ever closer to Net Zero.

Put simply, because occupier satisfaction matters to us, we track it. Who wouldn’t?

We use the Net Promoter Score ‘NPS’ model to check that, on balance, occupiers would recommend us. Integration of Occupier Smart Phone Apps, enables us to capture feedback easily.

Our Asset Management Leaders

The key to our success is our people

The key to our success is our people