ESG Consultancy &

Implementation

"We have a stewardship role in the communities we create. ISO14001 accreditation is part of the ‘E’ (Environmental strategies) that underpin our holistic ESG strategy"

We are committed to play our part in the property industry through the influence we have in project monitoring for funds and developers, by monitoring the impact our operations have, and the impact of key Client buildings and by increasing awareness and doing our part to drive consumer behavior change.

ESG informs our whole lifecycle approach

With the rise of residential real estate and Build to Rent properties in the UK, we are well versed in all ESG apsects. We support the delivery of great homes, build communities, and put sustainability and regulatory accountability at the core. The UK’s commitment to Carbon NetZero by 2050 is now core to all investment, design, delivery, and operating decisions. Given 52% of global warming comes from property, as a residential real-estate focused company, we are committed to managing and embedding ESG strategies in build, operation design, and retrofitting.

The NetZero commitment is an increasing expectation of consumers. Buildings that don't boast good ESG performance are stranding and don't achieve premium rents, so it is more important than ever to embed ESG strategies full lifecycle. The time for ESG is now!

The World Bank estimates, the real estate sector must reduce CO2 emissions by 36% by 2030 to support staying within the 2°C threshold.

Ringley's Sustainability Strategy & Policy

The United Nation's 2030 agenda for sustainable development has been achieved global recognition and been adopted by all member states. It provides a shared blueprint and sets out 17 sustainable development goals (SDGs); these are an urgent call for action.

Our one planet is home to us all, Ringley’s role is to foster stewardship; we track the 9 Sustainable Development Goals that are relevant to our operations and have embedded these into our sustainability strategy.

As a residentially led real estate business, we strive to be best-in-class; this means a responsible approach in our investment and asset management decisions as well as the sense of stewardship in the communities we create. This ongoing objective is one of the reasons our clients, partners, and staff are attracted to and loyal to us.

Our ESG Strategy formalises how we integrate environmental, social, and governance factors into our investment decisions, asset management strategies, and processes. We work with our investors and other partners to identify ESG opportunities, set targets, and report on progress.

ENVIRONMENT

Sustainable 1st

SOCIAL VALUE

Community 1st

GOVERNANCE

Accountability 1st

By resonating the threads of Sustainable 1st, Community 1st, and Accountability 1st in placemaking, we drive performance. Together, these guide us when planning aspirational living spaces and curating communities that foster a sense of stewardship.

Environment

Our environmental objective is to set an example that BTR schemes are a positive lifestyle choice that contribute towards the greening agenda

Social Value

Social Value is created when we extend the community we build into the wider community beyond the building itself; this also includes inviting the local community in.

Governance

In residential real estate, good governance includes an ESG decision matrix that considers the full lifecycle of construction methods and materials.

The facets of Asset Management and the sectors we operate in

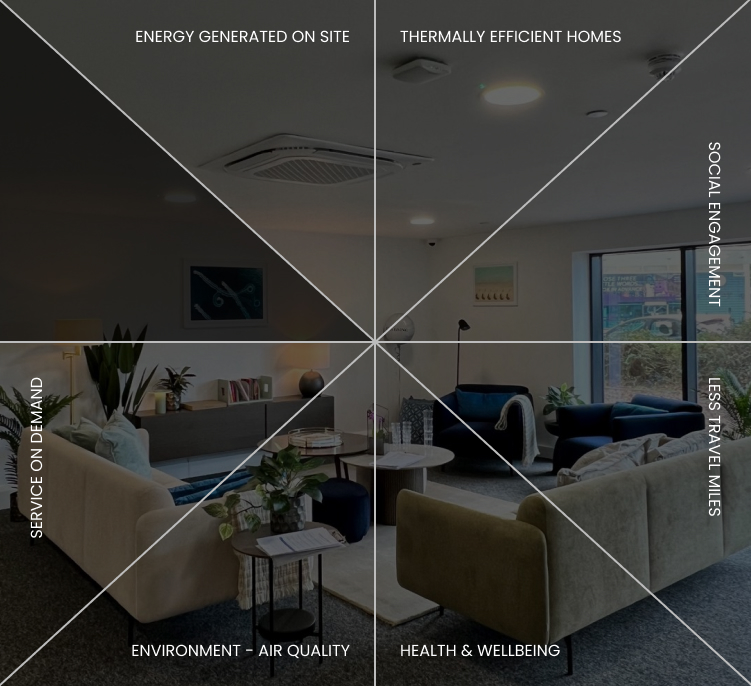

“E” & “S”

in action

Hunslet House: A Case Study

With SolShare technology installed, the 101 apartments at Hunslet House in Corby, a development by Hercul, are able to generate up to 60% of their own electricity each year.

Setting a new standard for the local area, we were able to rentalise the savings and achieve a 17% rent premium to local flats, and a 12% rent premium to local houses which are on average 32% bigger.

Welcome multi-family BTR to Corby!

Our Asset Management Leaders

The key to our success is our people