Experts in all things service charge including service charge management audits. Focussed on minimising service charge disputes

Property Service Charge Accountants

We are more than accountants, we are property accountants. All we do is property accounts which means service charge accounts, company accounts for Resident and Freehold Management Companies and RTM Companies.

Service charge accounting has to relate to what is permitted service charge expenditure under the lease and also for new build properties has to apportion expenses in the early days between the leaseholders and the developer. So, if you want to talk anything service charge accounts, get in touch today..

Finance Overview

"Experts in all things service charge including service charge management audits. Focussed on minimising service charge disputes."

Our extensive experience in real estate sector, caselaw insights and knowledge of RTM, Freehold, and Resident Management Company structures means that we are able to offer our clients a comprehensive service charge accounting service.

Ringley Final Accounts Service, (RFAS) offers bespoke property accounting services to property owners and service charge payers. We are part of the wider Ringley Group with all the expertise that brings. ...more about Ringley Group.

What's new for existing Ringley Management Clients: Final Accounts Service completes the Ringley one-stop-property-shop offering, and supports our values of 100% transparency. Clients to choose what financial package they want:

- Service charge accounts preparation for external audit

- Service charge accounts prepared for external certification

- Quarterly management accounts

- Company accounts

- Property Tax returns

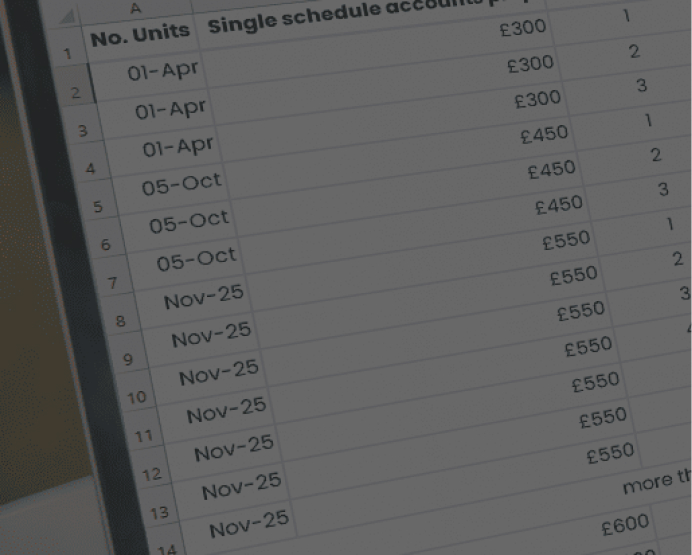

- Developers' new build accounts prepared with voids calcuation

If you are unsure what you need then ask us for a FREE, no obligation review to see if your service charge accounts are compliant.

Service Charge Accounts must follow the lease and Landlord & Tenant Act requirements

Ringley Final Accounts Service, (RFAS) offers bespoke property accounting services to property owners and service charge payers. We are part of the wider Ringley Group with all the expertise that brings. ...more about Ringley Group. What's new for existing Ringley Management Clients: Final Accounts Service completes the Ringley one-stop-property-shop offering, and supports our values of 100% transparency.

Clients to choose what financial package they want:

- Service charge accounts preparation for external audit

- Service charge accounts prepared for external certification

- Quarterly management accounts

- Company accounts

- Property Tax returns

- Developers' new build accounts prepared with voids calcuLation

If you are unsure what you need then ask us for a FREE, no obligation review to see if your service charge accounts are compliant.

Bespoke Property Accounting

Property is a tough business and service charge accounts are a specialist area. If your accounts don't stand up to court scrutiny you could lose the service charge debts you are trying to recover. RFAS specialises in accounts preparation and supports Ringley Legal, our solicitors practice, and Ringley Property Management. It is this joined up thinking that gives us the expertise to ensure that your service charge accounts are right.

For existing Ringley Clients

If you are already a Ringley Client, by choosing RFAS you can be sure that your accounts are compliant and presented in a user-friendly manner. We will get them done quicker, in fact within six months or we'll do them for FREE. Also, we will understand the expenditure better than an external Acountant if you wish us to attend your your Board meeting or AGM The obvious benefits of choosing RFAS is speed and a pro-active approach to queries. Your property manager is involved as our process includes a formal property manager debrief, as well as client/director involvement and the usual Ringley commitment to 100% transparency. Where the lease requires an audit, then it is accountant talking to another as they speak the same language.

Service Charge Accounts must follow the lease and Landlord & Tenant Act requirements

Ringley Final Accounts Service, (RFAS) offers bespoke property accounting services to property owners and service charge payers. We are part of the wider Ringley Group with all the expertise that brings.

Bespoke Property Accounting

Property is a tough business and service charge accounts are a specialist area. If your accounts don't stand up to court scrutiny you could lose the service charge debts you are trying to recover. RFAS specialises in accounts preparation and supports Ringley Legal, our solicitors practice, and Ringley Property Management. It is this joined up thinking that gives us the expertise to ensure that your service charge accounts are right.

For existing Ringley Clients

If you are already a Ringley Client, by choosing RFAS you can be sure that your accounts are compliant and presented in a user-friendly manner. We will get them done quicker, in fact within six months or we'll do them for FREE. Also, we will understand the expenditure better than an external Acountant.

My team will take the time to help Clients understand their accounts - simple

Call us

020 7267 2900Email us

md@ringley.co.ukProperty is a tough business and service charge accounts are a specialist area. If your accounts don't stand up to court scrutiny you could lose the service charge debts you are trying to recover.

RFAS specialises in accounts preparation and supports Ringley Legal, our solicitors practice, and Ringley Property Management. It is this joined up thinking that gives us the expertise to ensure that your service charge accounts are right.

Many get service charge accounts wrong. What the accounts must include is set down in the Landlord & Tenant Act 1985 and the Commonhold & Leasehold Reform Act 2002. As is how to treat surpluses and deficits too. Yet, every year recovery of bad debts is put at risk when ccountants ignore the lease or don't follow the letter of the law. It is law that where there are FIVE or more service charge payers, formal service charge accounts must be prepared or you risk a £2,500 (Level 4 fee) (see Section 25 – Landlord and Tenant Act 1985 & Section 37 – Criminal Justice Act 1982) as failure to comply with the requirements in sections 21, 22 and 23 of the Landlord and Tenant Act 1985 without reasonable excuse is a summary offence and the Landlord will be liable on conviction to a fine not exceeding level 4 on the standard scale (which at the time of writing is £2,500).

If you are already a Ringley Client, by choosing RFAS you can be sure that your accounts are compliant and presented in a user-friendly manner. We will get them done quicker, in fact within six months or we'll do them for FREE. Also, we will understand the expenditure better than an external Acountant if you wish us to attend your your Board meeting or AGM

The obvious benefits of choosing RFAS is speed and a pro-active approach to queries. Your property manager is involved as our process includes a formal property manager debrief, as well as client/director involvement and the usual Ringley commitment to 100% transparency. Where the lease requires an audit, then it is accountant talking to another as they speak the same language.

Case study

Client Fund Debtors

DEBTORS CLEARENCE

RFAS has cleared £763,3955 worth of debtors. Recoveries are as follows:Chauser Place-£17807.92-From ATLAS BMC Ltd ,King Regents Place-£16,972-British Gas,Heia Wharf Block C-£9,492-Ground Maintenance.

Case study

Fastest Service Charge

ACCOUNTS CIRCULATIONS

The Accounts has been circulated within 6 months and No Section 20B notice has been served - Northiam Management Limited as RFAS main objective is to issue the accounts within 6 months from financial.

Case study

5 Years of Accounts Cleaned

BACKLOG CLEAN-UP

Due to diminishing lease, the freeholder expenses cannot be recovered. There was also a variance on each service charge, thus the accounts were unfinished. This year we shortened the accounting period.